What’s Going On In Banking? Key Takeaways

Feb 13, 2025 | 3 min read

Blog

Blog

Aug 18, 2020|0 min read

Copied

Economists have long predicted monumental economic change due to modern technological innovation. For instance, John Maynard Keynes wrote in 1930 that modern innovations would result in a 15-hour work week within two generations. And Juanita Kreps, economist and commerce secretary under Jimmy Carter, predicted in 1970 that the rise of computers would enable people to retire at the age of 38.

When it comes to banking, predictions have similarly been overblown. For example, in the early 1970s experts believed that ATMs would replace tellers (“up to 75 percent,” according to a New York Times article in 1973).

But it hasn’t happened. Instead, tellers jobs have grown slightly faster than the general labor force. We now have nearly half a million ATMs and nearly the same number of tellers. ATMs simply have not replaced humans.

The reality is that while ATMs reduced the number of tellers per branch (from 21 to 13 in the average urban branch), the reduction made it cheaper to build branches — which increased the number of branches and therefore increased the number of tellers. As it turns out, the same thing happened with the textiles in the 19th century: Automation decreased prices, which increased demand as well as the total number of people working in textiles.

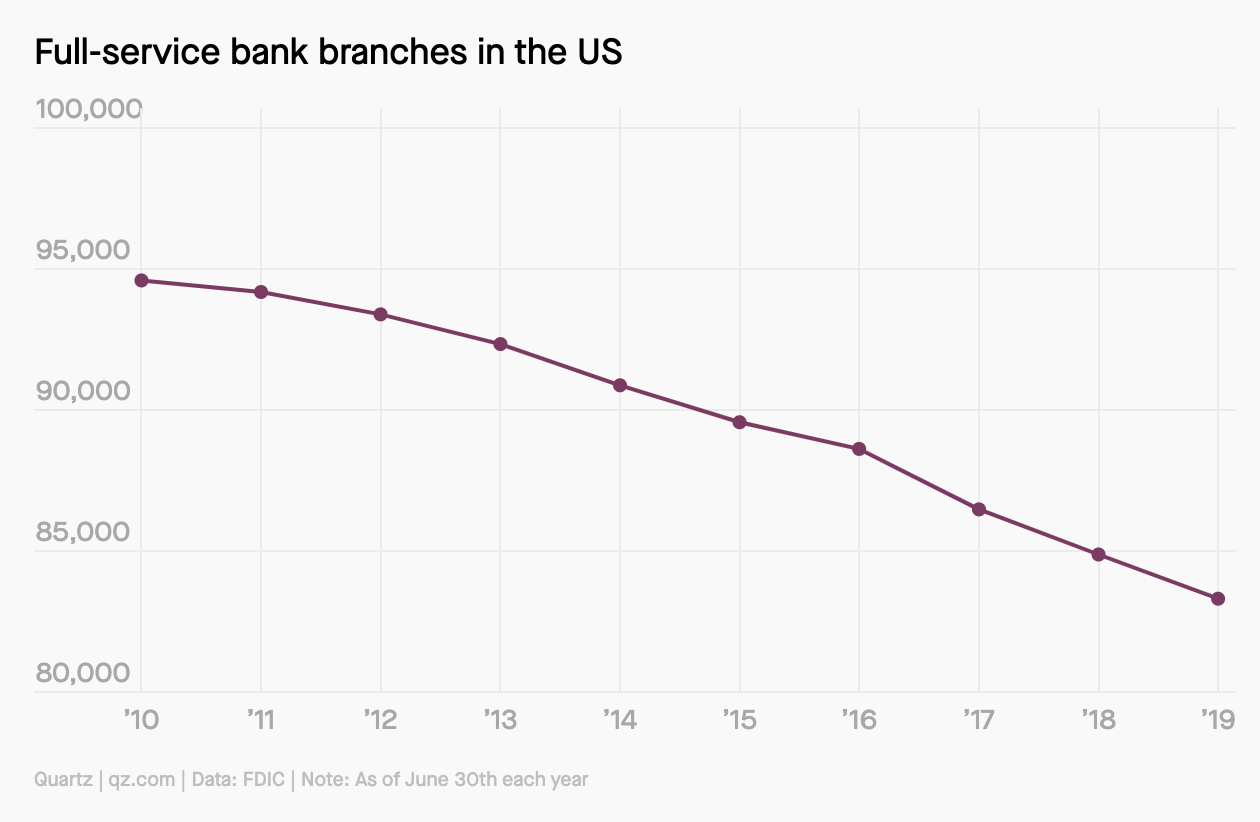

And yet this time might truly be different. When it comes to banking, financial institutions are now closing branches more often than they’re opening them, and the net number continues to plummet, as shown in this graph from Quartz.

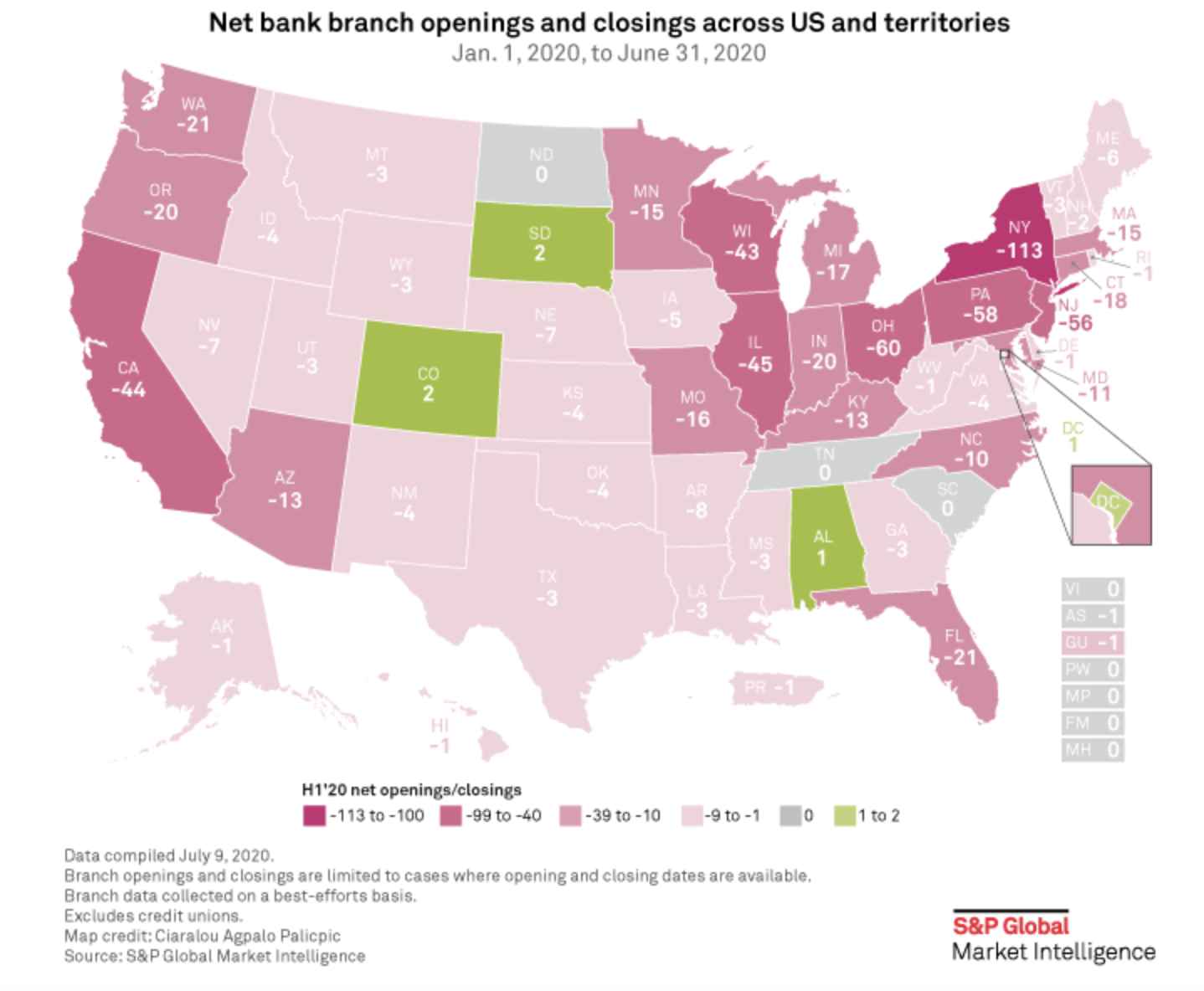

This trend has continued in 2020, with only 3 states seeing a marginal increase in net branches and the rest seeing a drop:

In other words, there are now fewer tellers per branch and fewer branches overall. It’s no wonder, then, that the Bureau of Labor Statistics now estimates there will be 12% fewer tellers by 2028.

But that’s just the cusp of the evolution in retail banking. Financial institutions are now facing innovation on a range of fronts, including:

And then there’s the matter of COVID-19, which has upended the workforce. As we recounted in the Ultimate Guide to the New World of Banking: Since COVID-19 restrictions went into place, deposits at the largest banks ballooned by more than $1 trillion, offices went empty, remote work became widely acceptable, drive-through banking made a comeback, and the primary reliance on digital services was swift and decisive.

Take one example: Citi experienced an 84% increase in mobile deposits and a 10x boom in Apple Pay usage in the wake of the crisis. In light of this data, Jane Fraser, president of Citi and CEO of Global Consumer Banking, says, “Banking has changed irrevocably as a result of the pandemic. The pivot to digital has been supercharged.”

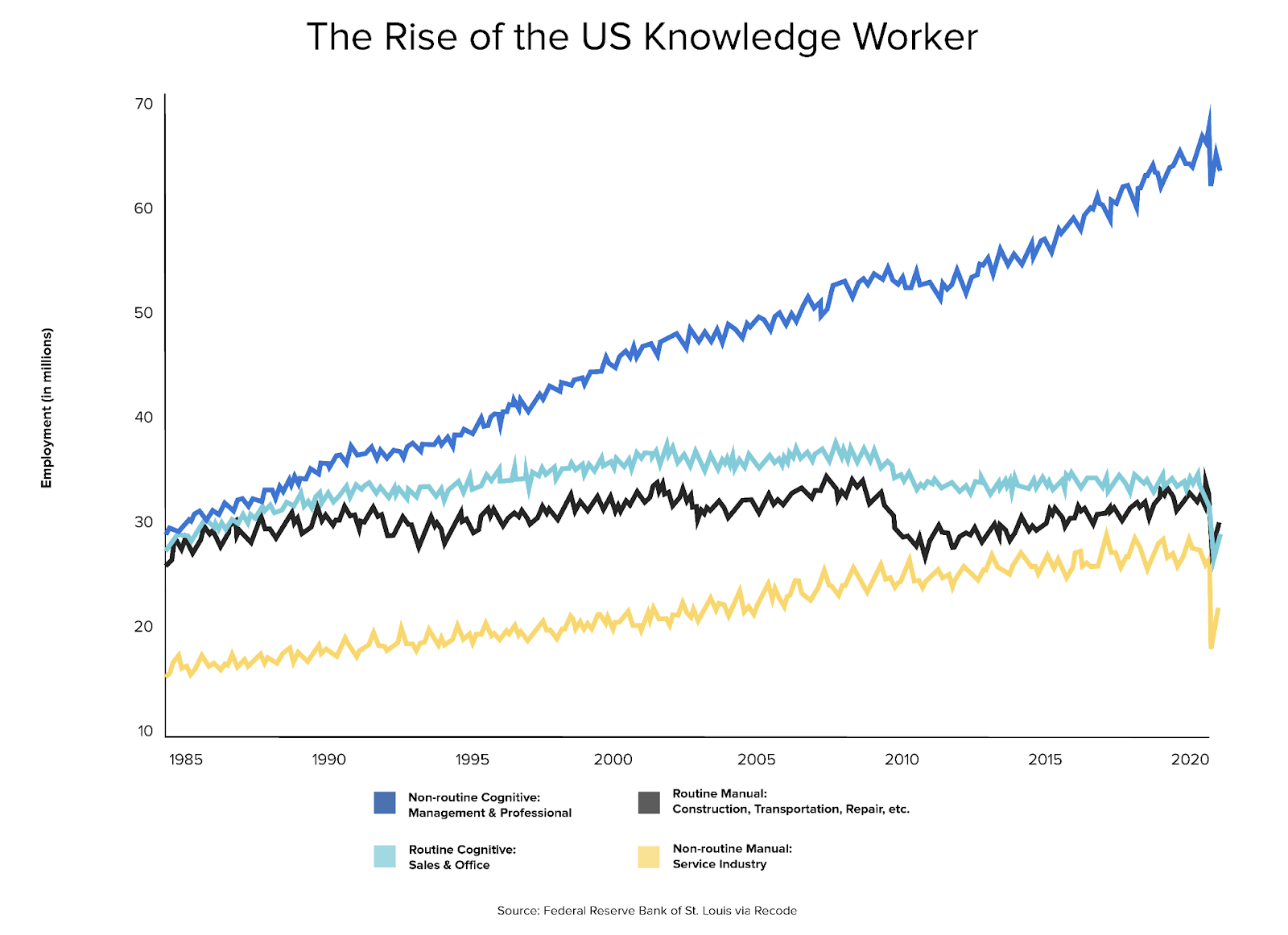

These monumental changes have been reflected in the broader market as well with the steady rise of the knowledge worker, as defined as non-routine cognitive work.

Knowledge work: non-routine cognitive work

Sales and office (i.e. tellers and customer service reps): routine cognitive

Construction, transportation, repair: routine manual work

Service industry: non-routine manual

Of these types of work, knowledge work fell the least throughout the COVID-19 restrictions, while the other three feel considerably, especially the service industry.

In other words, it’s no longer just a story of ATMs versus human tellers. It’s a story about a host of new technologies combining into an omnichannel experience —along with a worldwide pandemic that has been brutal to every type of job but least brutal to knowledge workers.

And that changes everything.

So, it’s true that ATMs didn’t reduce tellers, and it’s clear that today’s tech will.

For more, read the Ultimate Guide to the New World of Banking.

Feb 13, 2025 | 3 min read

Feb 4, 2025 | 6 min read

Dec 13, 2024 | 3 min read