Solving Your Biggest Challenge: Putting Data into Action

April 30, 2025 | 3 min read

Blog

Blog

April 22, 2016|0 min read

Copied

We recently caught up with Mohamed Khalil, the Head of Product, Data & Marketing at Moven, to talk about user experience. He shared with us his thoughts and explained how Moven is set to re-imagine how people interact with their money.

Banking today is a frustrating experience. Most interactions today result in two types of friction: experiential and contextual friction.

Experiential friction is the kind that has users clicking through multiple screens or jumping through hoops to complete an activity or access information. Contextual friction is the amount of effort that they then expend to answer basic questions like how much can I spend today, or do I have enough money for this month.

At Moven, we set out to create a frictionless, differentiated service with a unique value proposition. By being digital first, it allowed us to rethink the customer experience. We are not only focused on creating a digital, frictionless account, but believe that improving financial wellness is the need that consumers most want addressed.

Most banks are focused on getting consumers to open savings, lending or investment accounts. We want to find ways to help consumers improve their behaviors so they can spend smarter and save more. Opening these accounts becomes an outcome, not the primary selling point.

Our foundational principle is to remove the amount of cognitive load required to make and act on a smart decision. To do so requires highly contextual experiences that provide real time insights and look forward instead of back.

We ask ourselves what question is the user trying to answer. How much can I spend right now? Should I be saving more? Do I have enough? For each of these inquiries, the value is not in showing them past behaviors, but predicted behaviors and how they can change. In other words, instead of giving you your balance or cross-selling a savings account, let’s solve the problem of helping you save in a more consistent and sustainable manner by giving you insights on when and how you can change your behaviors.

Over time our vision is that this capability can extend to very specific use cases. You might be planning a family vacation; how can we help you better understand and be prepared for the typical travel, accommodation, day to day spending and other costs? You might be considering a car purchase: how do we give you insights into the financing, maintenance, fuel, insurance and other costs that you might encounter? In the first instance perhaps we provide you with a short term line of credit, in the second instance we might be able to secure you a car loan. But in both cases the goal is always to help you make a smarter decision by helping you understand how these choices will impact your lifestyle and financial health.

A lot of the contextual challenges come down to data quality and predictive ability. MX allows Moven to have a complete view of a user’s finances with well cleansed and categorized data that can feed our algorithms. When you look at transactional data in its raw form, there are significant issues of consistency and completeness. Consumers will only trust our insights if we have a clean and usable dataset to better understand their transactional behaviors.

Most financial service UIs are based on an accounting paradigm, which is not surprising since that is how we are all trained to think about our finances. But this approach has limited appeal because most users prefer not to approach their money this way. Recent advances in behavioral economics have demonstrated a number of heuristics, biases and fallacies that form the basis of consumer financial decision making.

As a result, our emphasis has been rethinking financial service UIs to accommodate new paradigms that are eerily familiar. These paradigms attempt to simplify complex data or processes into highly consumable interactions that are intuitive to the user.

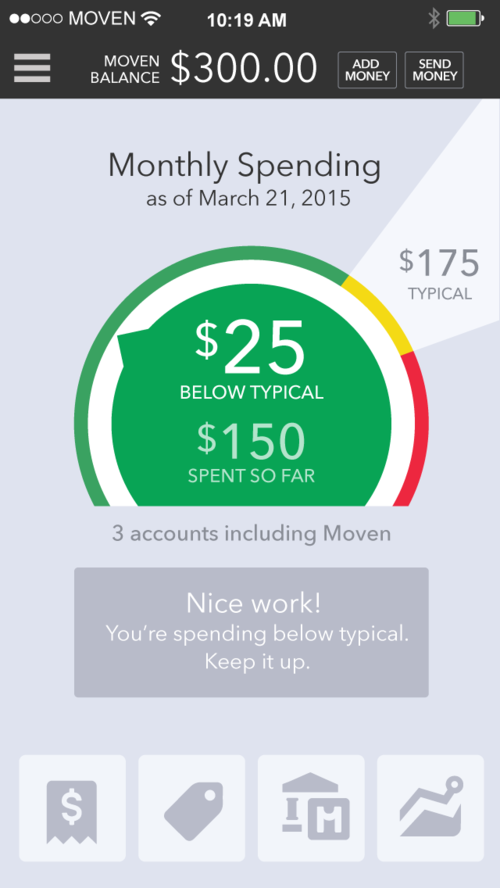

For example, our spending meter takes the point in time view of balance and the backward looking view of transaction history and re-imagines it as a velocity of spend. For the user it answers the very important question of “How fast am I spending? And is it faster than I should be?” Rather than having to spend an inordinate amount of time sifting through transactions, removing transfers, payments and adding up the remainder and then determining how that compares to similar points in prior months, Moven does all of that in real time and give you a simple response. You are X dollars in the red, yellow or green.

Providing contextual feedback requires us to leverage data effectively, and wherever possible in real time. MX is one of many critical data sources that we use to drive our financial wellness experience. Without it, we simply couldn’t provide our full range of service with the level of insight and accuracy we have today.

Today we carefully select the types of insights we push to users. Over time there is certainly a risk of overwhelming them with a barrage of notifications. To avoid that we will be doing two things. First, we will empower the user to customize their financial wellness feedback settings in a manner that best suits them. Second, our engagement engine provides insights and feedbacks in an iterative and agile manner that measures the relevancy, value and impact of various interactions to improve their prioritization and presentation over time.

We aren’t trying to constantly ping our customers. We believe that, depending on the user, 2 - 5 interactions a day is the right balance, whether that is across mobile, smart watch or other wearable devices. The intent is not to increase time on site or in app, but to make sure that money insights are always available when you need them so you can make smarter choices.

We believe revenue moments will naturally emerge from the financial wellness use cases that we are building towards. Those interactions may be more complex and require the user to spend more time within the experience, but they will always be designed to be as frictionless as possible. Whether it’s providing you with savings, borrowing or investing solutions, all of these will be embedded intuitively in a way that makes them approachable without feeling like cross sell. When users see that these tools are part of how they can improve or manage their financial health, they will engage much more meaningfully.

April 30, 2025 | 3 min read

March 6, 2025 | 2 min read

Feb 11, 2025 | 2 min read