Overcoming the Challenges of Digital Transformation

December 13, 2024 | 3 min read

Blog

Blog

Copied

Last week Yahoo Finance is rolling out a new savings app and the OCC is asking banks to proceed with caution.

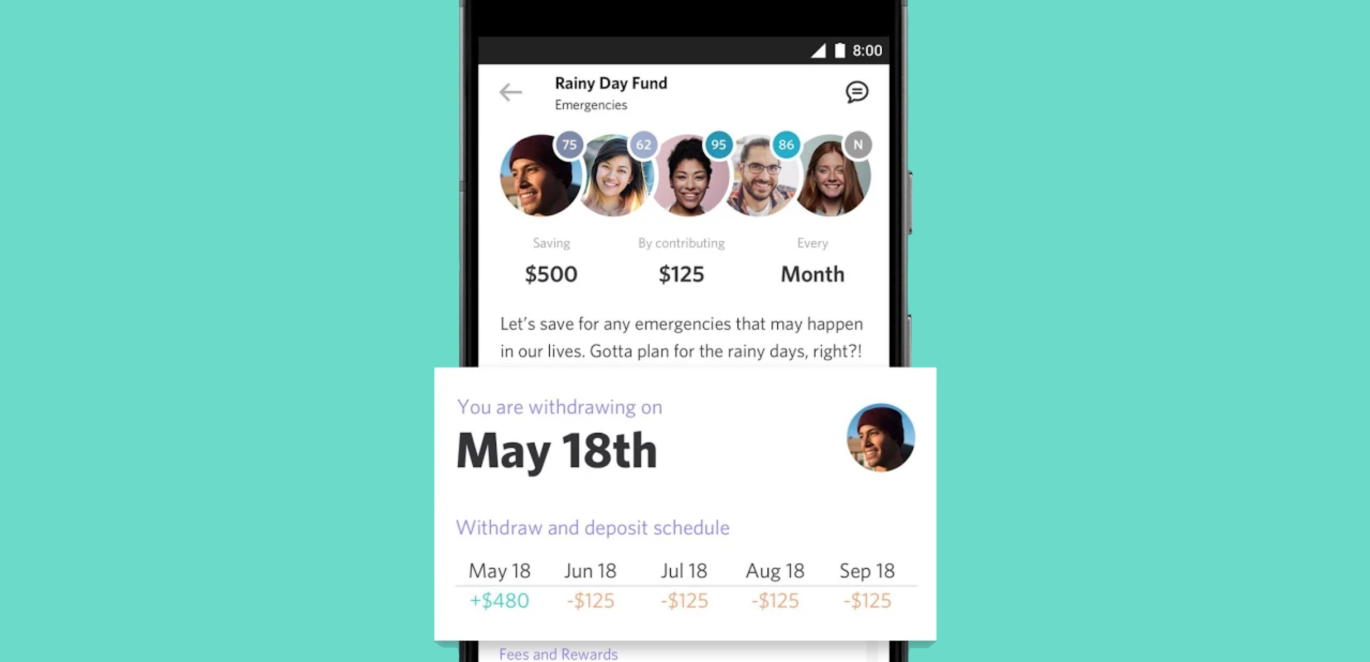

Yahoo Finance has released their new app, Tanda, which allows small groups of people to save money collaboratively. As Sarah Perez explains, the idea of pooling money together improves saving habits: 'The app is based on the age-old “rotating savings and credit associations” concept, which pushes people to save through the use of collective pressure. In other words, while it’s true that you could just set aside a set a fixed amount of money on your own, Tanda’s makes saving a more collaborative and social construct.'

The latest OCC Semiannual Risk Perspective report publicized their concerns that banks maybe reveling too much in the current economic climate. The report says that factors have fostered a healthy credit environment but the tide could change quickly: “These factors are driving incremental easing in underwriting practices and increasing concentrations in select loan portfolios — leading to heightened risk if the economy weakens or markets tighten quickly.'

As larger banks look to provide customers with deeper insights and better tools to improve their personal financial wellness, Citi is leading the charge by beta testing new products. As a spokesperson for the bank says, financial wellness is the priority moving forward: 'Customers will be able to view their data across their various banking accounts, and Citi promises to deliver insights and solutions to improve the user’s financial health.'

Read more at Bankrate

'That these companies are choosing to up their engagement with fintechs suggests they've been pleased with their strategic investments in the past, and continue to believe that acquiring new technology will bear more fruit than building in-house. This is good news for the fintech industry, as the three incumbents will likely fund a plethora of fintechs and implement their solutions throughout the next year.'

'The foundation of banking has changed little over the centuries. What has changed is the way consumers prefer to manage their finances and the ability for organizations to deliver personalized solutions in real-time.'

Read more at the Financial Brand

'Citigroup has finally revealed its gender pay gap: 1% across its workforce in the U.S., U.K. and Germany. It said the pay for U.S. minorities is also 99% that of their nonminority counterparts. The company intends to fully close the gap by increasing the pay of women and U.S. minorities.'

'Bitcoin and other virtual currencies were a mere afterthought last week at the first of two Senate Banking Committee hearings on AML policy, but cryptocurrencies came into clearer focus in the second hearing Wednesday.'

December 13, 2024 | 3 min read

December 11, 2024 | 2 min read

November 7, 2024 | 2 min read