We knew that taking on a task this big would require in-depth research. We’d have to get to know our members on a different level, and it would be difficult to quantify.

Sharon Krizic

Senior Vice President, Financial Wellness, LGFCU

MX Reveals Customer Financial Strength Scores for LGFCU

Local Government Federal Credit Union is a not-for-profit credit union based in North Carolina. Its mission is to support those who work for and in local communities — including local government employees, volunteers, fire, rescue EMS workers, and local families.

Improving member financial health is the highest priority for LGFCU, but it needed better data to measure financial health and empower members to become financially strong. Before providing the tools for empowering financial health, LGFCU needed a system that could precisely identify the financial health score for each member.

LGFCU turned to MX’s professional services team to develop Financial Health scoring from member data. MX provided a study and analysis of 86,000 members using a financial health survey* to assist LGFCU in understanding its members’ financial health. *The survey was based on research from the Financial Health Network and provided an overall health score to each LGFCU member who completed it.

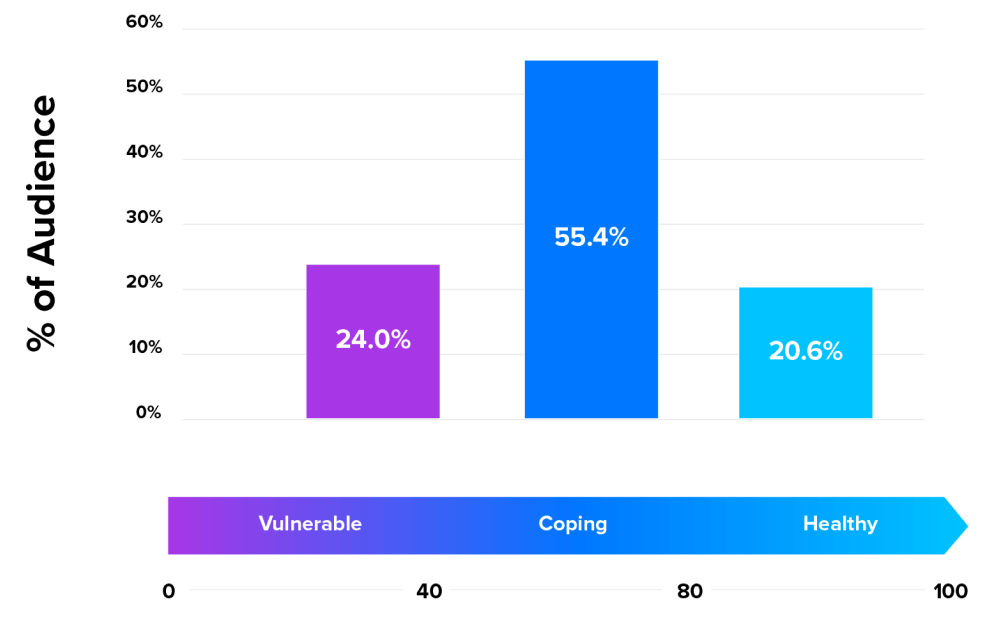

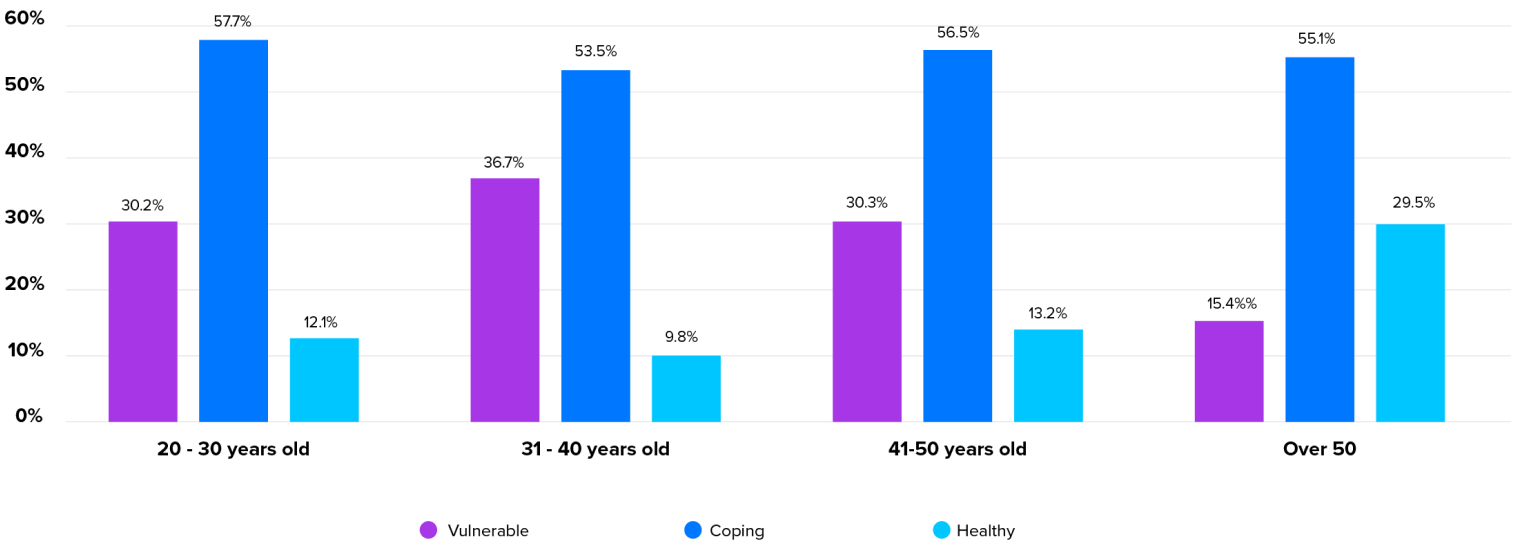

The study gave the necessary insight into how LGFCU could positively affect the financial wellness of its members. From the results, LGFCU was able to score its members into three separate categories:

Survey Method

% of each health category

MX was also able to identify metrics for spending behaviors, borrowing profiles, income versus savings, and insurance coverage planning. Interestingly, the study found no correlation between age or income and the composite financial health score of the member. Even when members were older or made more money, they were still at risk to have poor financial health. While many institutions tend to categorize members using these two factors, the data shows that they aren’t strong indicators for an individual’s real financial health.

We knew that taking on a task this big would require in-depth research. We’d have to get to know our members on a different level, and it would be difficult to quantify.

Sharon Krizic

Senior Vice President, Financial Wellness, LGFCU

With industry-leading data insights from MX, LGFCU was able to measure member financial health and identify members who were financially vulnerable, coping, and those thriving. With these new insights, LGFCU can now precisely assist members— no matter where they are on their journey to financial strength.

Improving customer experience

Using data to better understand customer needs

Identifying personalized messages based on persona

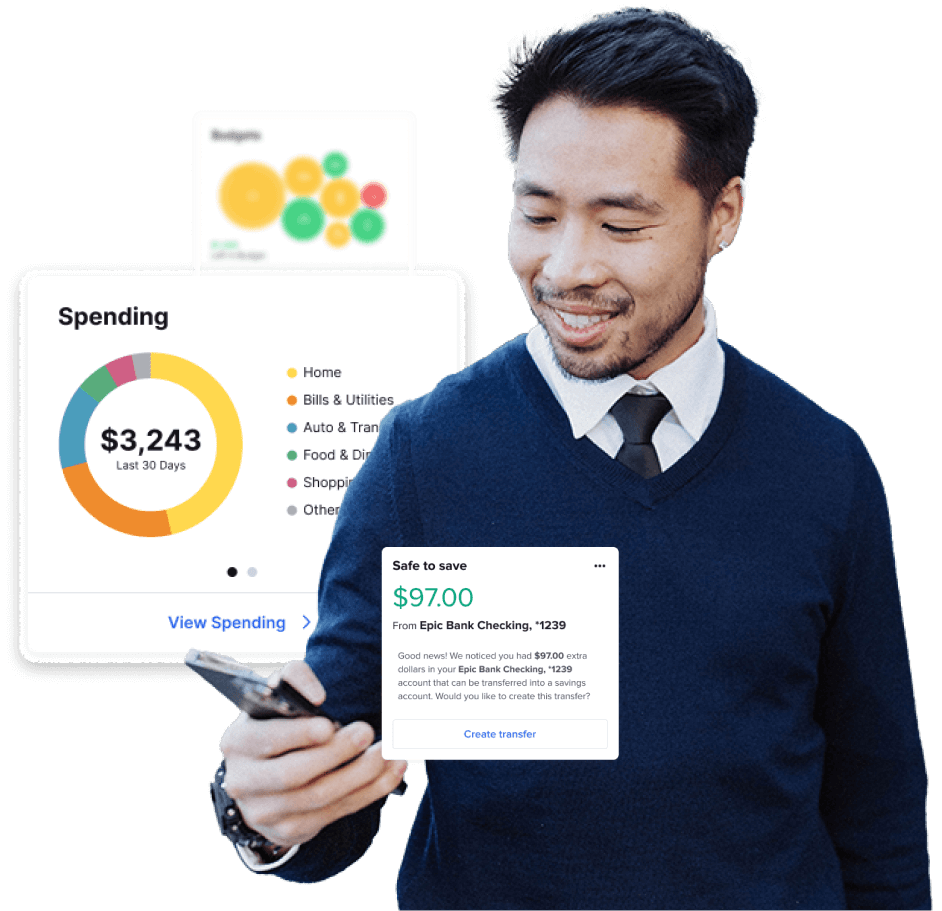

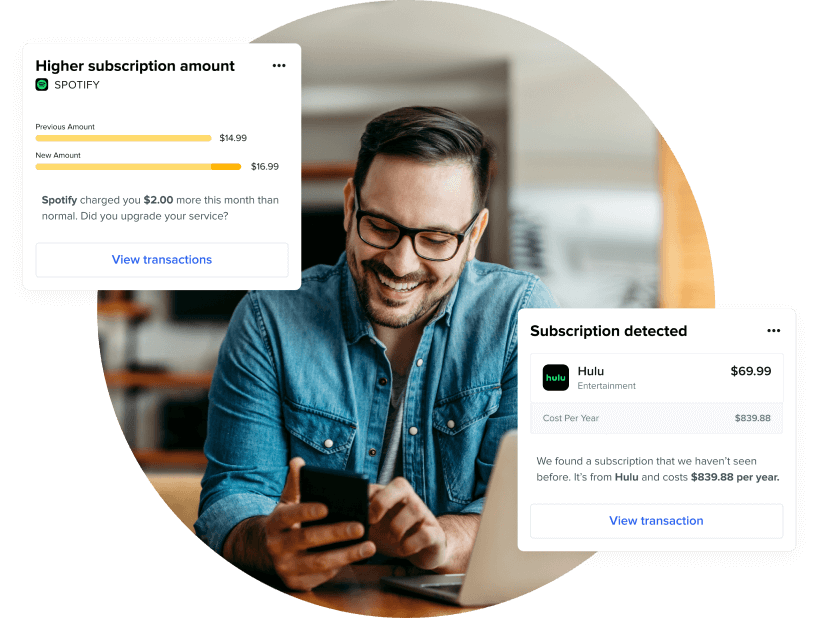

MX’s account aggregation solutions enable consumers to easily connect and view all of their financial accounts in one place — and give financial providers full visibility into consumer financial data to better meet their needs.

MX Insights delivers a combination of personal financial management, predictive financial guidance, and financial wellness capabilities that helps organizations to translate data into actionable insights. It enables organizations to gain more value from their data, power the best experiences, and improve engagement so their consumers can become financially strong.

Explore how MX can help you get the most from financial data and build better money experiences for consumers.