Introduction: From Intermediary to Advocate

Neil Gabler was nearing the end of a successful writing career. He’d published five books (with the movie rights to one being purchased by Martin Scorsese) and hundreds of articles in major publications. In addition, he’d won a host of awards and fellowships.

And yet when it came to his finances, he was barely scraping by.

In a tragic viral cover story for The Atlantic, Gabler tells of how, through a series of financial hardships including stagnant wages and his kids’ exorbitant college tuition costs,he drained his savings, leaving him a financially precarious position. “You certainly wouldn’t know it to talk to me,” he writes, “because the last thing I would ever do — until now — is admit to financial insecurity.” The situation was so dire that in the event of an emergency, he couldn’t pull together $400 to cover it.

He’s not alone. People in every socioeconomic status frequently find themselves living paycheck to paycheck even when they’re hesitant to admit it.

What does this widespread tragedy mean for people who work in financial services, especially in the wake of the global pandemic of 2020?

More than anything, it’s a sign that many of your customers are in desperate need of financial support —support you can provide.

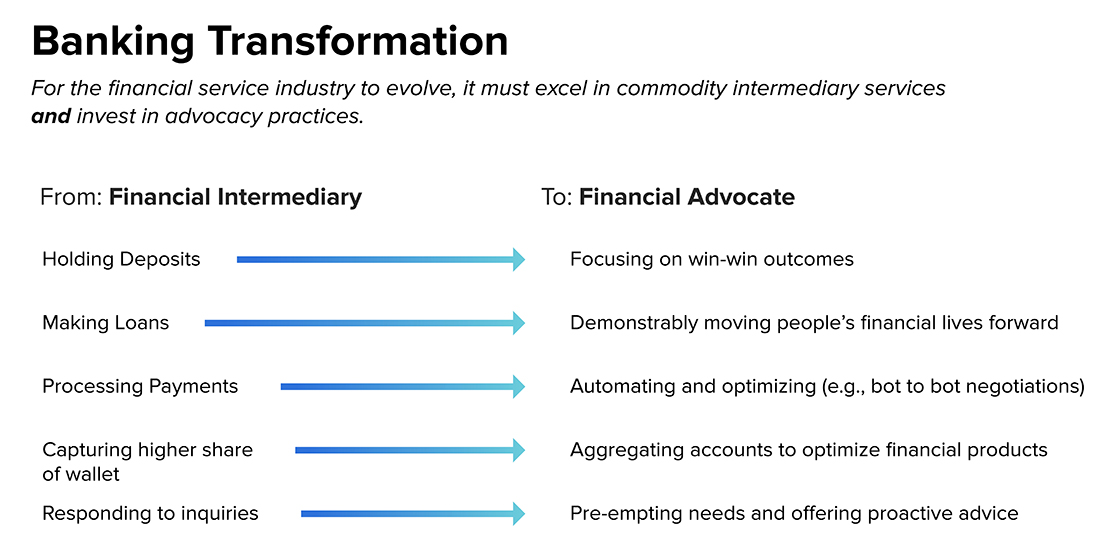

To provide this support, you must make the transition from being a financial intermediary to becoming a financial advocate, a process that entails helping your customers transition to the next level of financial strength no matter where they are today. Depending on individual needs, you might help one customer move beyond living paycheck to paycheck while helping another customer understand the basics of investing.

It’s all about personalization and stewardship, along the lines of how a therapist caters their advice for an individual client or how a teacher reaches a particular student. After all, you can’t say you’re a trusted advisor if you only give cookie-cutter financial advice. You have to consider the full context as well as the emotional impact of your work, creating a culture where your customers know that you’re there to take care of them when they need it.

The Why: Advocacy and Customer Lifetime Value

Why should you care about advocacy? More than anything, it helps you reach win-win outcomes for you and your customers.

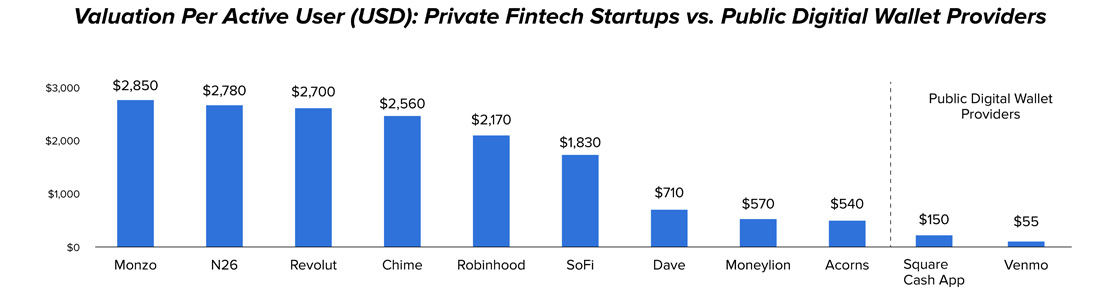

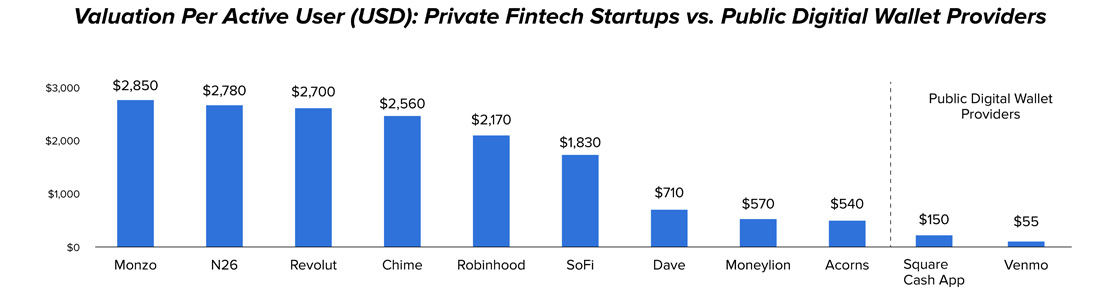

Let’s start with the value of advocacy for financial service services companies. You likely spend hundreds of dollars to acquire each new customer because you know that potential customer lifetime value is worth the cost. Novantas pins average customer lifetime value around $2,000 to $4,000, and Dan Rosenbaum at Oliver Wyman puts it at roughly $4,500. In addition, valuation per active customer at fintech startups such as Monzo, N26, and Revolut measures in the high $2,000s.

Of course, customer lifetime value differs widely depending on customer metrics, including the type of products and services each customer uses. For instance, StrategyCorps analyzed over 2 million accounts at 100 financial institutions and pinned an average dollar amount to three core segments: super-profitable, profitable, and unprofitable. They found that super-profitable customers consist of roughly 10% of all customers but provide 67% of total relationship dollars, while unprofitable customers consist of roughly 40% and provide 1.4% of total relationship dollars.

In a similar vein, Javelin Research writes that customers who are most likely to adopt digital banking technology —particularly personal financial management apps —are 18 percent wealthier than average customers. These customers also have “relationships with more financial institutions and manage more accounts” and are more likely to own every major financial product, including savings accounts, retirement accounts, mortgages, and car loans. Finally, they’re also more likely to “charge purchases to a credit card (52% vs. 36%), swipe a debit card (46% vs. 24%, or pay with a prepaid or payroll card (10% vs. 4%).”

How do you enjoy these tremendous profits? It’s primarily about focusing on long-term value. As Bradley Leimer, Co-founder of Unconventional Ventures, said in an interview with MX, “banks need to make customer lifetime value actually translate to a lifetime value from the financial provider — not the other way around.” He added, “With long-term advocacy programs like this, the incentives of financial institutions will be aligned with the incentives of account holders, and long-term relationships can develop.” Finally, he said, “I want to see banks not just rebuilding the core, but rebuilding the core value proposition for the customers so it benefits all customers in the long term.”

“Banks need to make customer lifetime value actually translate to a lifetime value from the financial provider — not the other way around.”Bradley Leimer Co-founder at Unconventional Ventures

A range of experts in the industry back this call to advocacy. Forrester Research says, “Customer advocacy is the key driver of loyalty at retail financial services firms. Loyalty, in turn, yields the most sustainable revenue growth for these firms. ... Focusing on customer loyalty is no longer just a smart strategy. In an age of empowered customers, it is an imperative.” KPMG says, “Banks that embrace change and systematically transform themselves to meet new customer demands will achieve a competitive advantage in the marketplace. Those that continue to ponder—or worse yet, resist—change will suffer.” And Infosys writes, “With the increasing commoditization of banking services, banks today need to look beyond their traditional goals – like driving customer satisfaction, customer revenue, and customer retention. Instead, they must focus their energy on winning customer advocacy.”

“Focusing on customer loyalty is no longer just a smart strategy. In an age of empowered customers, it is an imperative.”—Forrester Research

Put simply, as you become a true advocate for your customers, you’ll provide them with lifetime value and simultaneously win long-term brand loyalty.

The Current Situation: Consumer Survey Results

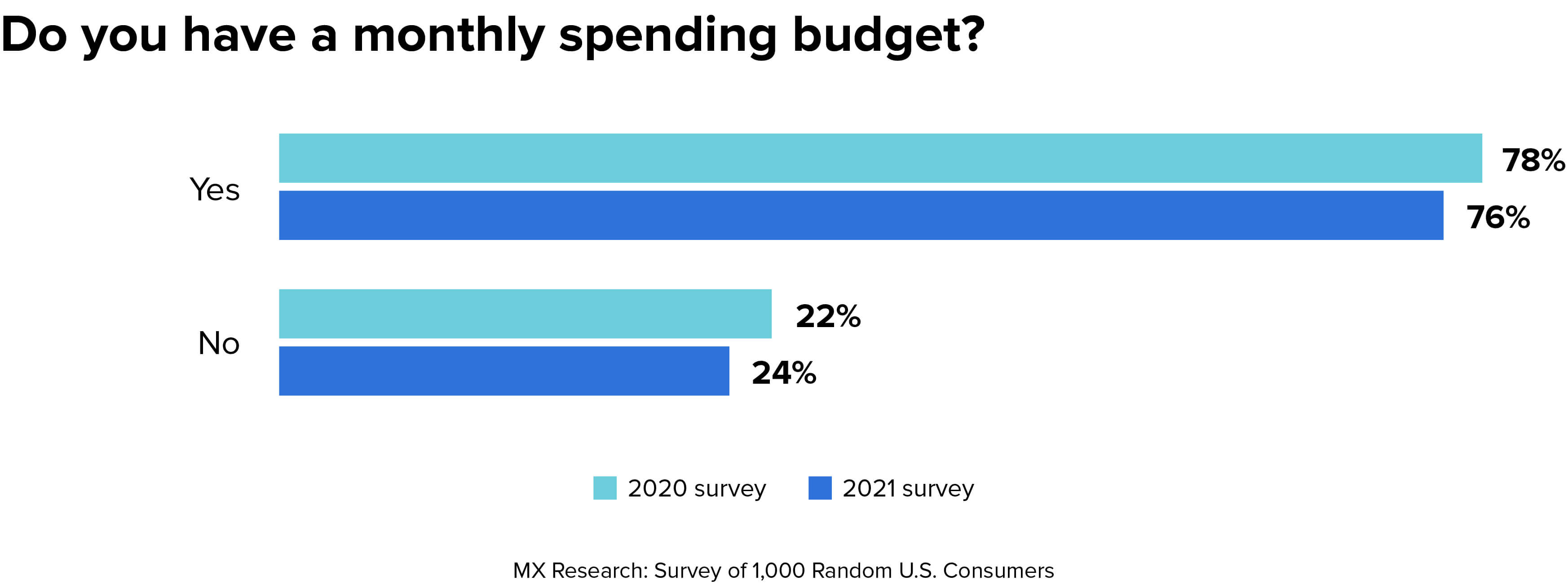

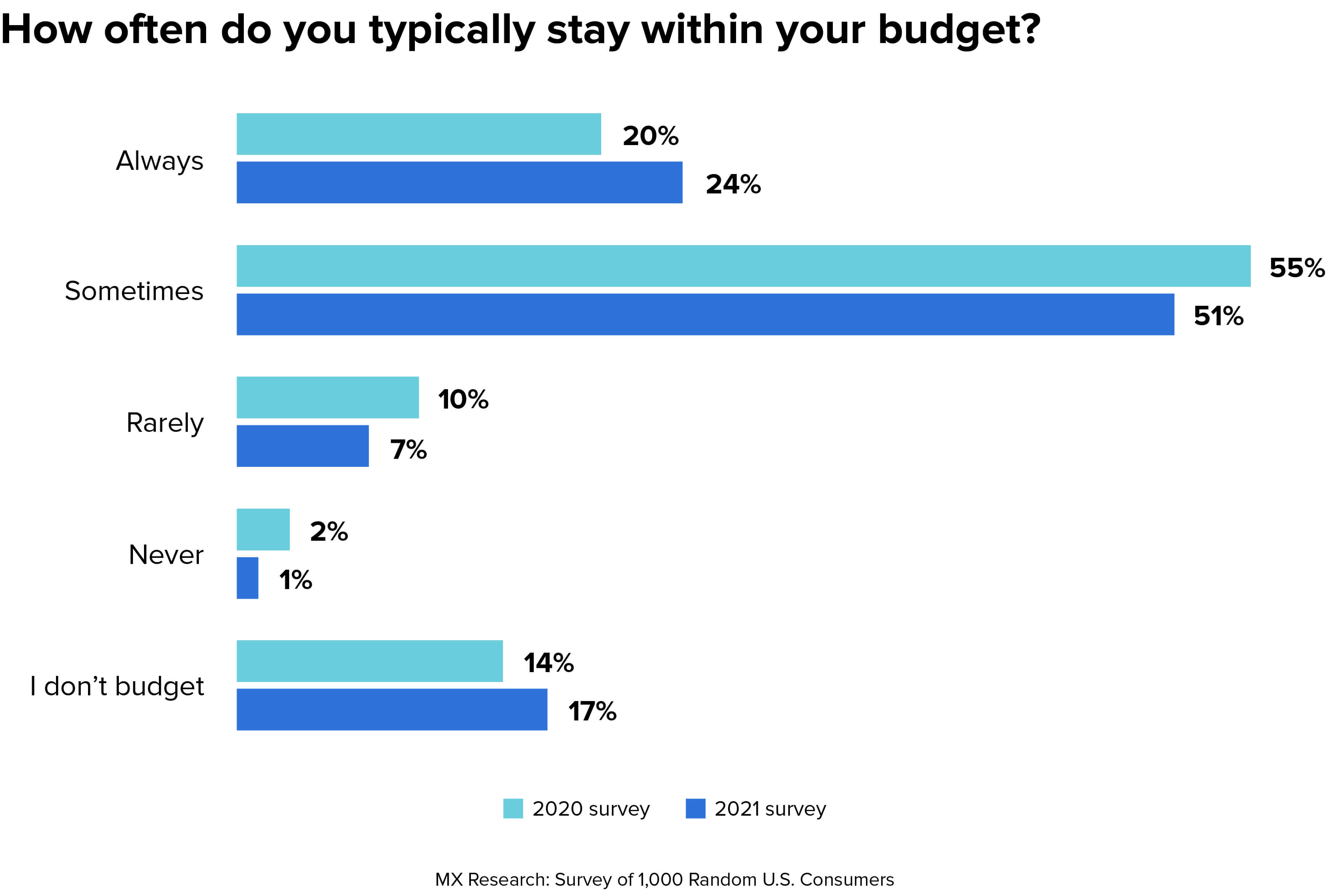

Given that empowering financial strength can yield big results all around, it helps to first get a clear sense of what customers need. To this end, we surveyed 1,000 random U.S. consumers about their financial habits. in January 2020 and then again in January 2021. Perhaps the most surprising result is how consistent these numbers remained, despite a global pandemic. It turns out people’s views and habits around money didn’t shift dramatically. By understanding these survey results, you can start to plan for what will most help your customers.

We surveyed 1,000 random U.S. consumers about their financial habits.

We started by asking whether consumers have a monthly spending budget, discovering that 76% say they do in 2021 while 78% said they did in 2020. Since a difference of 2% is within the margin of error, we can assume nothing really changed on this front year to year.

It’s one thing to have a budget and another thing entirely to actually stick to that budget. When we asked about the latter, we found that 24% of consumers say they always adhere to their budget, while 51% say they only do it sometimes.

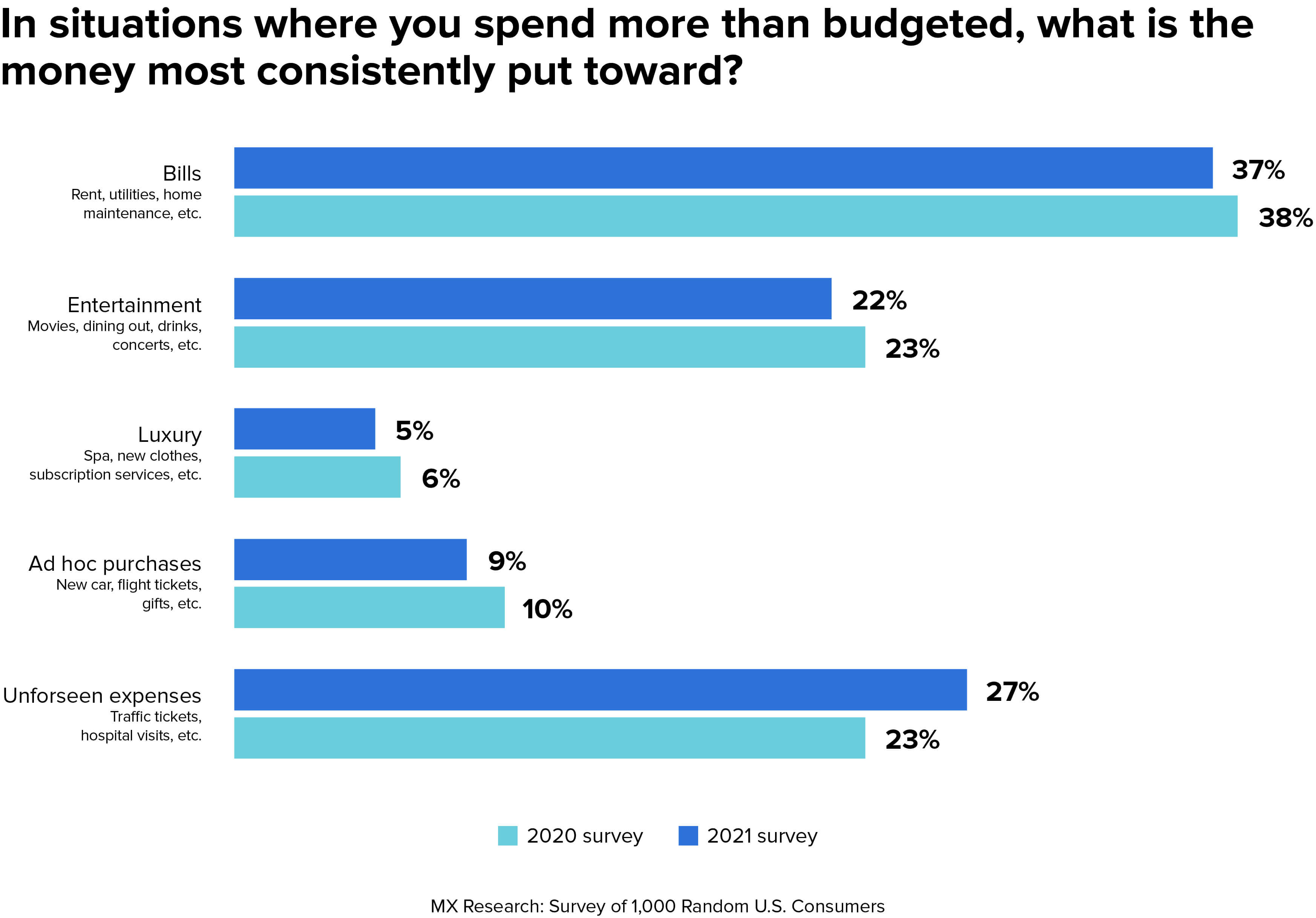

We followed that question with one about what most consistently causes people to spend more than they budgeted. The top three answers were regularly scheduled bills (38%), unforeseen expenses (23%), and entertainment (23%). Notably and perhaps strangely, the biggest shift from 2020 to 2021 on this question was the drop in unforeseen expenses.

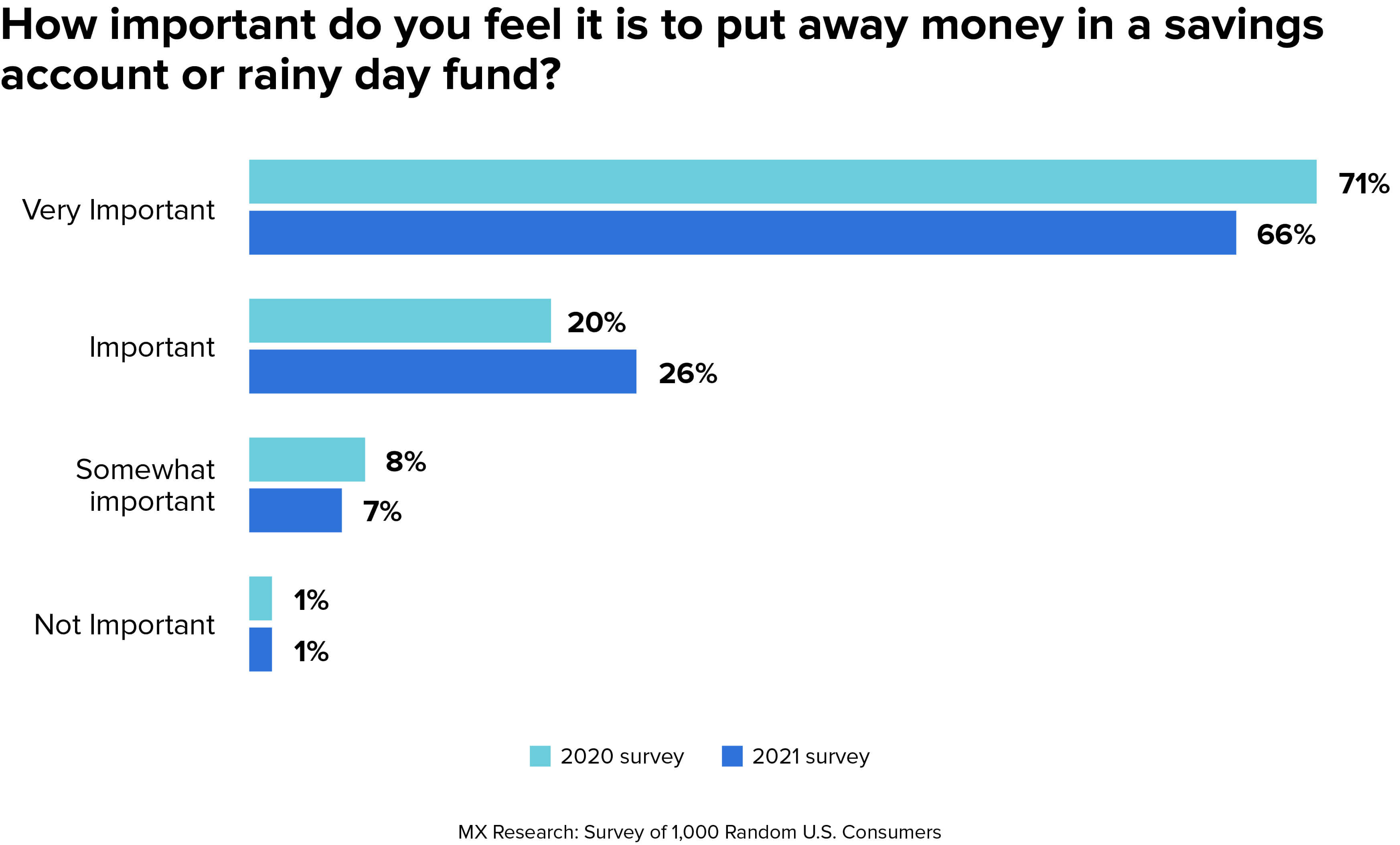

Despite struggling to always stay within their spending budget, 92% of respondents say it’s either important or very important to put money in a savings account.

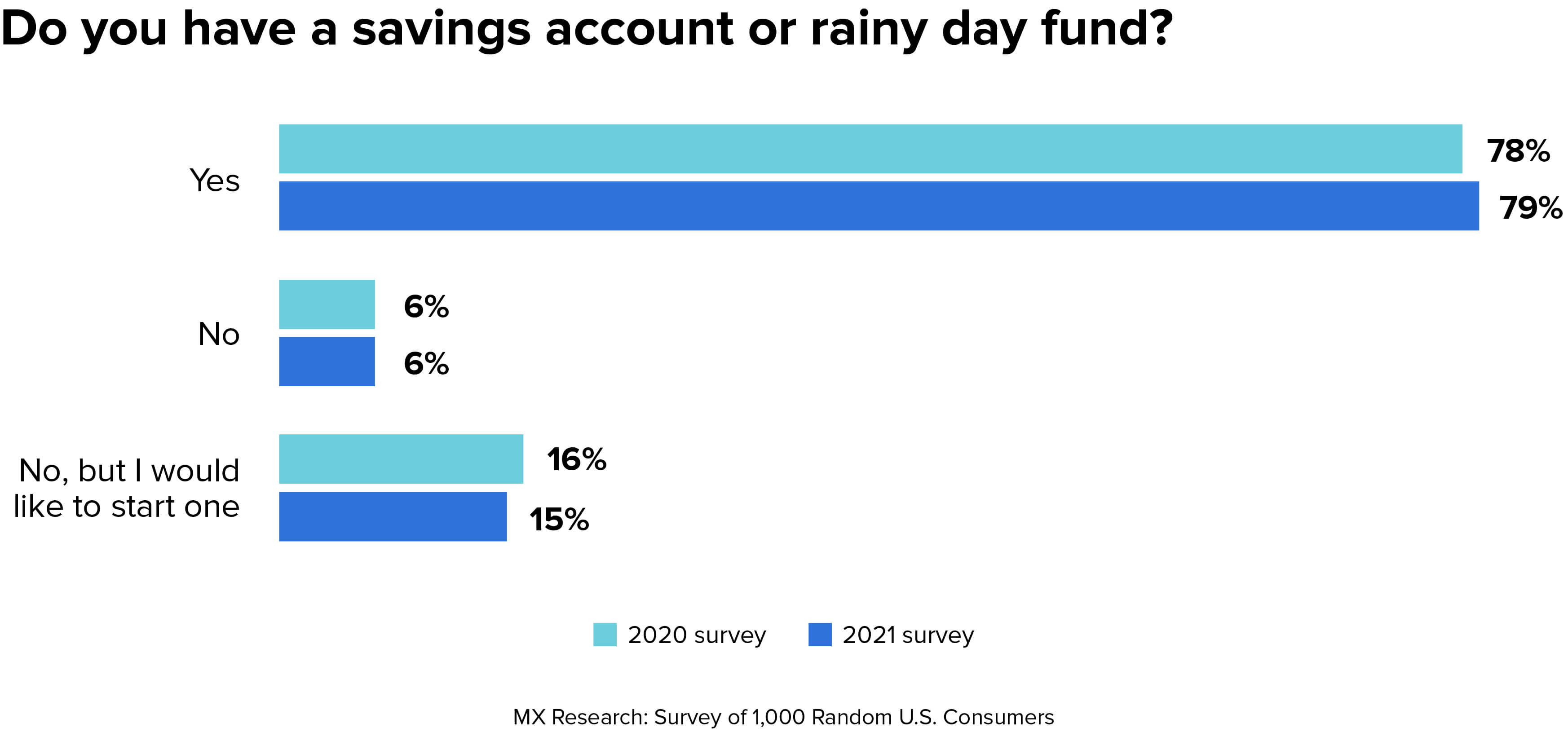

In addition, 79% of respondents say that they have a savings account or rainy day fund. This may seem surprising if you’ve ever heard the statistic that nearly half of Americans couldn’t afford a $400 unexpected expense. The good news is this: That statistic is wrong. It’s a misrepresentation of Federal Reserve survey data, which in actuality shows that the percentage of Americans who can’t afford an unexpected $400 expense is only 12% —still far too high, but not half. Fortunately, the overwhelming majority of Americans have some money stored away.

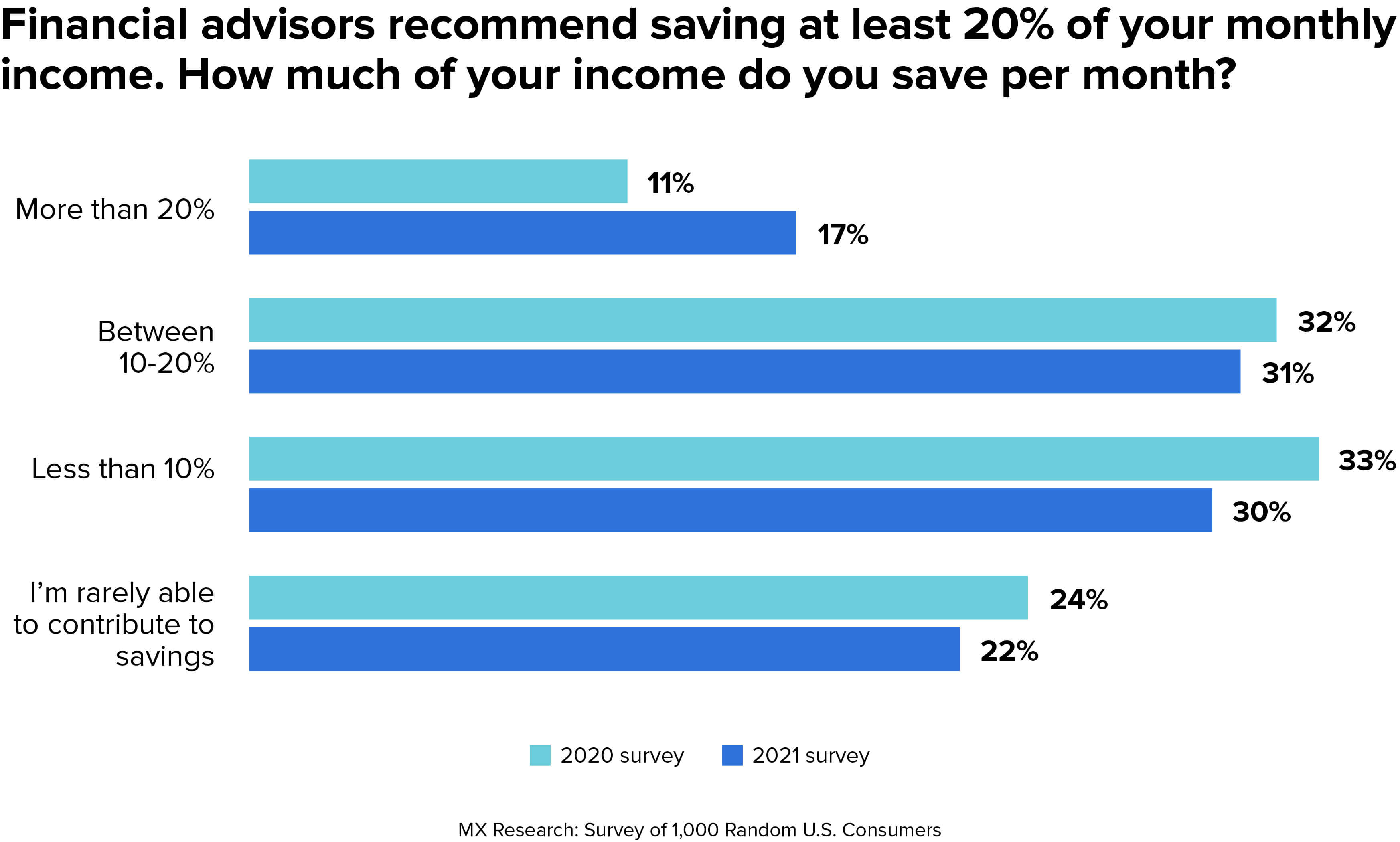

And nearly half (48%) say that they save at least 10% every month. Of all the survey results, these changed the most from 2020 to 2021, with more people saying they save more than 20% — perhaps out of worry for what the future holds.

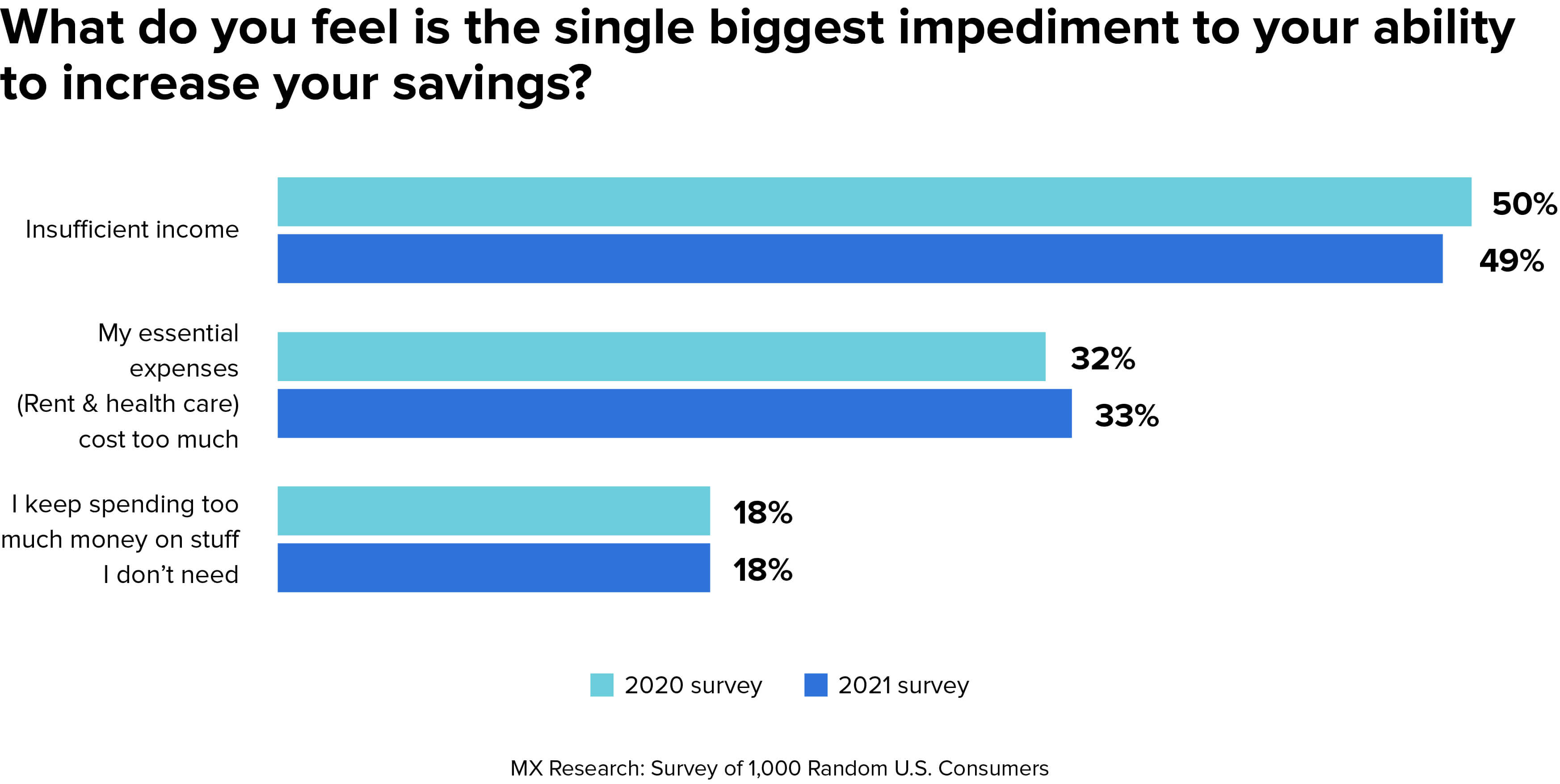

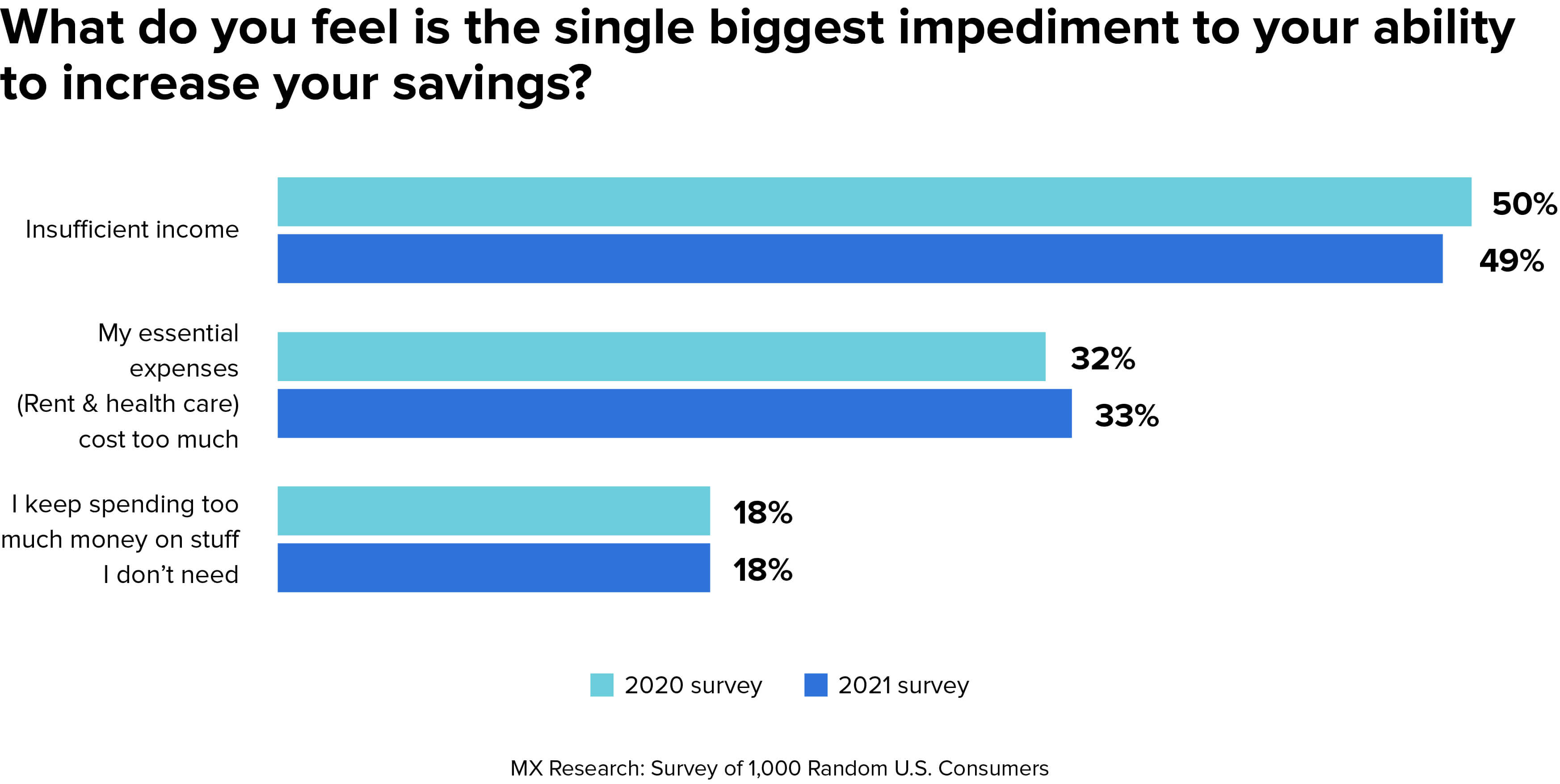

We then asked respondents what is the single biggest impediment to increasing savings, and we found that 49% listed insufficient income, 33% listed essential expenses such as rent and healthcare, and 18% listed spending money on stuff they don’t need. More than anything, this indicates that any financial guidance strategy offered at a bank should include helping customers with increasing their income.

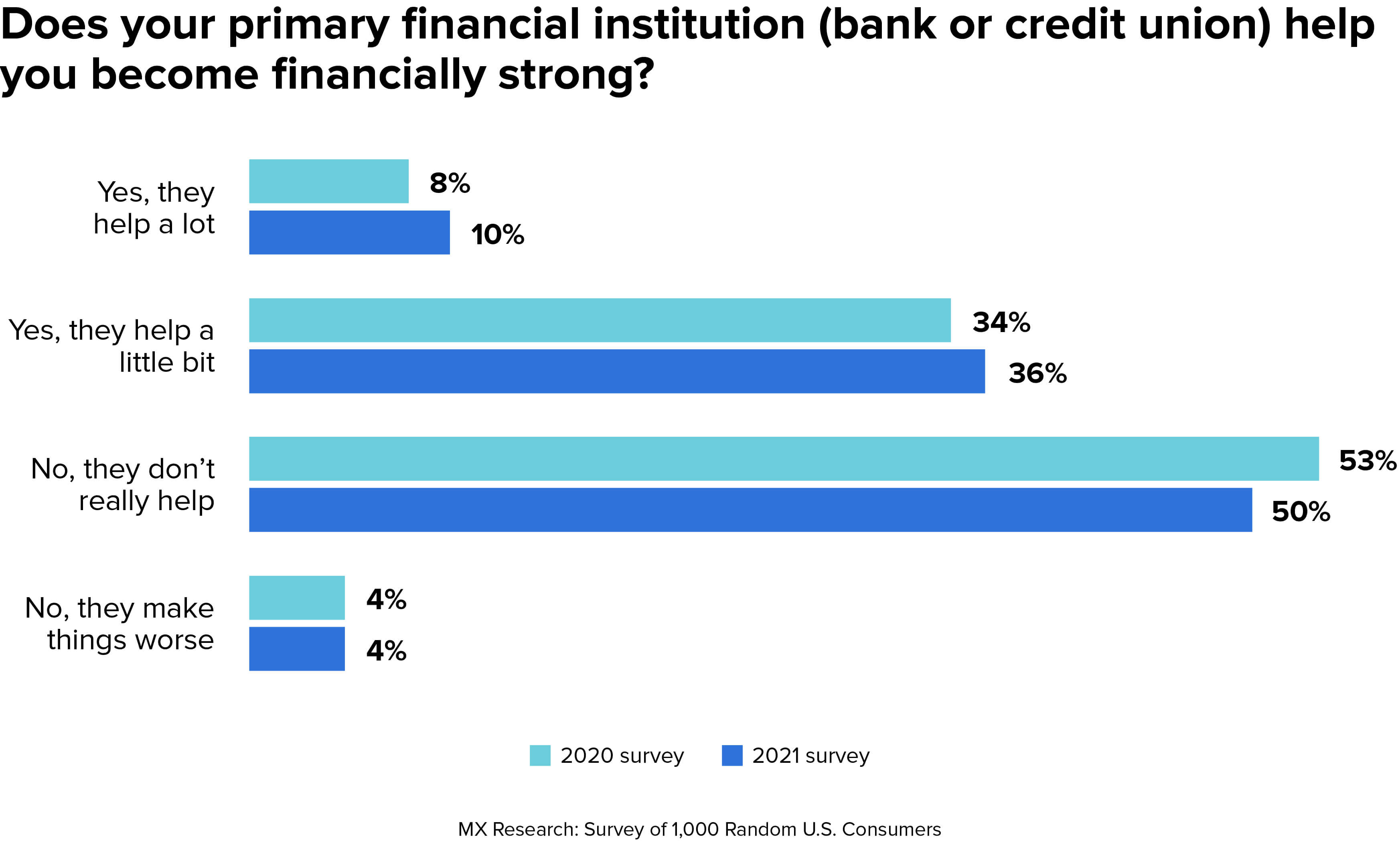

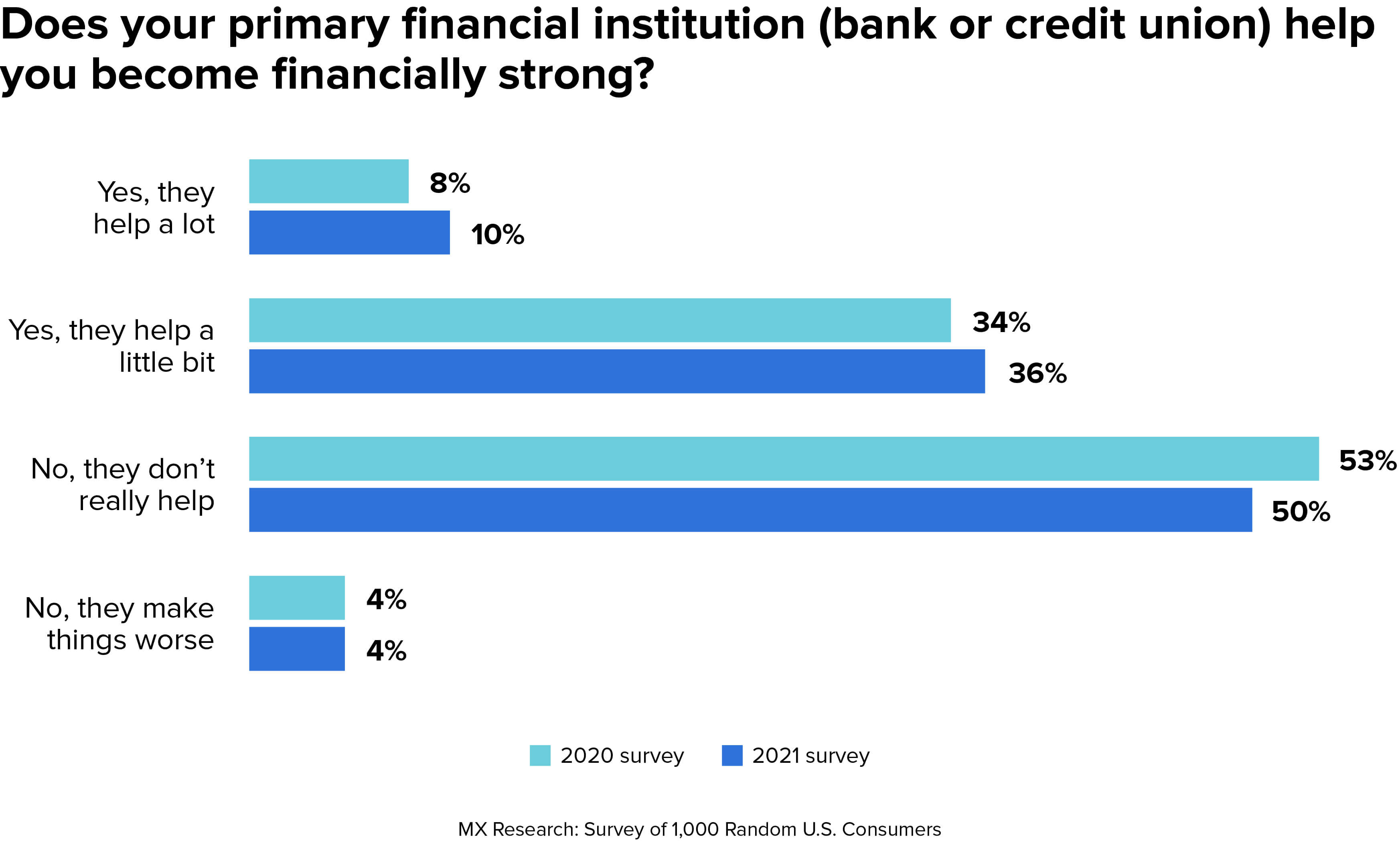

When it comes to whether financial institutions are improving their customers’ financial strength, 46% of consumers say they help at least a little bit, with 10% saying they help a lot and 36% saying they help a little bit. Taken together, this means there is plenty of room for improvement here since 55% of consumers say their financial institution doesn’t help at all, with 4% saying their institution makes things worse. Whether or not that’s true in practice, the fact that this is the perception of consumers is still critical information for financial institutions to keep in mind (though keep in mind that perception of help isn’t the same as actual help). If you offer financial guidance but your customers aren’t aware of it, your brand benefits little from your services.

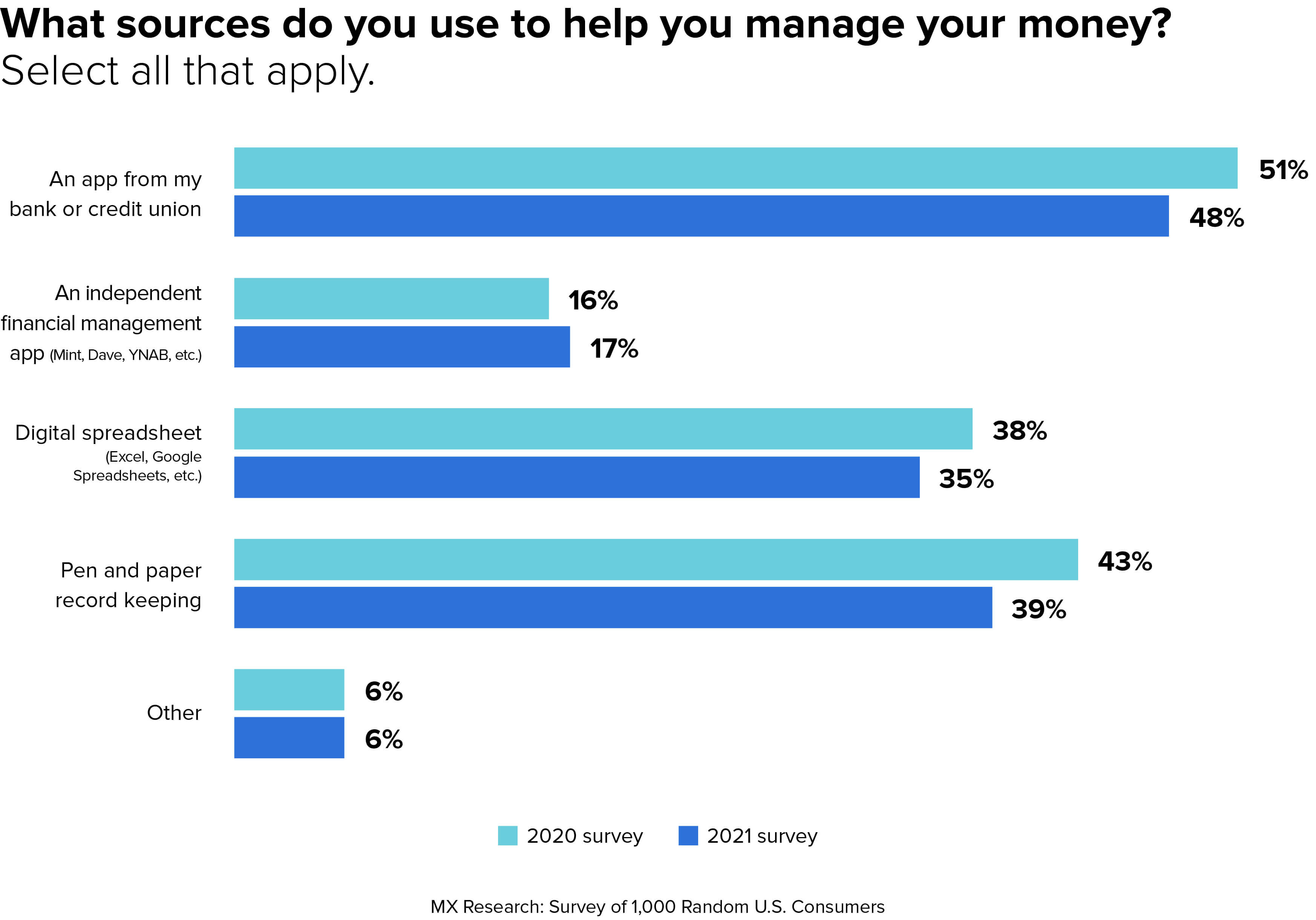

Given that only 46% of respondents say their financial institution helps them become financially strong, it’s a bit of a disconnect that 48% of respondents say they use an app from their bank or credit union to help them manage their finances — ahead of pen and paper (39%) and a digital spreadsheet (35%).

To further understand American consumers’ financial situation, the American Payroll Association shows that more than 70% of Americans live paycheck to paycheck, and Bankrate’s Financial Security Index suggests that 3 in 10 Americans have no emergency savings at all.

With all this data in mind, it’s clear that people need help —and that companies in financial services are an instrumental part of the solution.

So, how do you proceed? We’ve outlined one way to think about it below.

Be an Advocate at Every Step of the Financial Journey

Building on the framework established by the Financial Health Network, we define seven steps of financial strength: earn, spend, save, borrow, plan, protect, and grow.

Before we dive into the details, it’s important to note that each one of these steps requires you to start with the ability to view the full financial picture of your customers. After all, if you’re only aware of your customers’ held accounts and have no insight into their held-away accounts, you can’t provide true financial insight. For example, without real-time insight into your customers’ financial situation, you might incorrectly nudge an individual who is buried in credit card debt to aggressively invest in their 401(k) account, hurting their financial strength in the process. The key to each of these steps, then, is having the ability to see your customers’ full financial picture in one place. Only once you have that view can you provide automated financial guidance at each step.

One more thing: This framework can serve as a way for you to organize your products and services instead of using the traditional method of organizing by business lines (a method that too often turns customer outcomes into an afterthought). When you organize by outcomes, as these seven steps do, you make these outcomes all the more likely.

1. Earn

As we showed in our survey, half of consumers say that the single biggest impediment to increasing their savings is insufficient income.

Given this data, leaders at financial institutions should ask themselves how they’re doing on this front, especially since the income side of the balance sheet is the most untapped source of customer value for companies in financial services. Are you giving your customers guidance on how to ask for a raise? Are you providing insight on the types of career choices that pay the most over the long term? Do you give young customers tools to understand the tradeoffs between different college decisions as those decisions relate to potential income?

There’s a lot of guidance you can give customers around finding and thriving in a side hustle or a gig job. For instance, you can add tools that connect customers directly with this type of work in the vein of apps such as Stoovo and Steady. You can also show customers examples of people in your community who have succeeded in making money on the side. You might even hire a handful of people who have succeeded in this way to write how-to guides or serve up webinars for your customers, showing them step-by-step how to find side-hustle success. For more on this topic, read our Ultimate Banker’s Guide to the Future of Work.

All of this might seem like it’s beyond the scope of your business as a financial services company, but think of it this way: When your customers increase their income, they have more money for deposits and loans, resulting in long-term gains for them — and you.

2. Spend

While only 18% of respondents said that the biggest impediment to increasing their savings is buying stuff they don’t need, it’s clear that people still want help to manage their spending while predicting tradeoffs to future purchases.

With the right approach and implementation, you can show your customers their spend-to-income ratio, pointing out ways they can cut non-essential costs. You can also show customers their spending broken down by category so they can quickly and easily see their problem areas. In addition, spending tools can help customers stay on top of bill payments so they don’t fall behind.

A range of fintech companies are leading out on this front, including MX, Dave, YNAB, and many others. MX partners with more than 2,000 financial institutions and fintech companies to reach more than 30 million end users, Dave has reached 4 million users including 1.2 million Gen Z users (their target audience) by teaching people how to manage their money, and YNAB is bolstered by a clear-eyed financial philosophy that encourages users to make sure every dollar has a job.

The sheer number of people using financial management apps are a sign that you should consider offering them as well. After all, if people log into a competitor’s app to see all their accounts, it means they aren’t logging into your digital portals as often to check their balances and manage their money. This in turn means that your competitors are obtaining key data about your customers’ finances. As a result, you may find that you understand less and less about your customers while your competitors understand more and more.

The behavioral economist Dan Ariely adds that financial institutions can help people avoid being driven by short-term desires by guiding them to focus on positive, long-term directional shifts. He explains, “I want a banking app that says, 'You're headed in the right direction, but be careful: You're spending a little bit too much.'”

“I want a banking app that says, 'You're headed in the right direction, but be careful: You're spending a little bit too much.'”— Dan Ariely, Behavioral Economist

Ariely also says that the point of a spending app like this shouldn’t just be to convince everyone to spend less all the time. “We get people to feel as if it's always good to spend less than the budget,” he says. “No. Life is also about happiness. If somebody says, ‘I want to spend $200 a month on coffee,’ then if they spend less, that's not good.” Jane Barratt, Chief Advocacy Officer at MX, agrees, saying, “Most of us have unnecessary expenses that we can cut. The trick here is to find a few expenses that you can live without that don’t negatively impact your happiness.”

The key, then, is to couple a financial management app with automated financial guidance that’s individualized for the needs of each customer. For an example of this, see Pulse from MX.

3. Save

As your customers increase their income and get their spending under control, they open up the possibility of building a basic emergency fund. At that point, you can offer additional insight into how much more they should be saving each month in light of their income, essential expenses, and life stage to build a savings fund that can cover three-months of living expenses. Once they reach that goal, you might then help these customers save up for their dream vacation or a dream home—illustrating in every case how each financial decision they make comes with tradeoffs.

Sometimes the guidance your customers need might be as simple as highlighting how much they’re spending on each category and asking them whether they actually want to spend in that way or whether they would rather spend on something else. For instance, if you can highlight that they’re spending, say, $50 a month on subscriptions to services they no longer use, they might gladly follow a suggestion to cancel those subscriptions and put that money elsewhere.

You can also implement an automated “slide to save” product that nudges customers on track bit by bit toward true financial strength. To illustrate: at the beginning of the COVID-19 pandemic, BECU identified a segment of its members who did not have automatic savings set up and likely needed help finding ways to save money. To address this, BECU implemented a Quick Save feature in their mobile app, which allows members to easily transfer funds to their savings account by using the 'slide to save' panel on their dashboard. By making the act of saving as simple as a swipe, BECU helped their members build a savings habit. To date, Quick Save has helped members transfer more than $1.5 million into savings accounts.

More than anything, the key is to create an experience that’s engaging and delightful so your customers have an incentive to keep coming back to your digital offerings. If you can show customers that you’re invested in their long-term interests, you can spark the motivation they need to stay committed to their financial goals.

4. Borrow

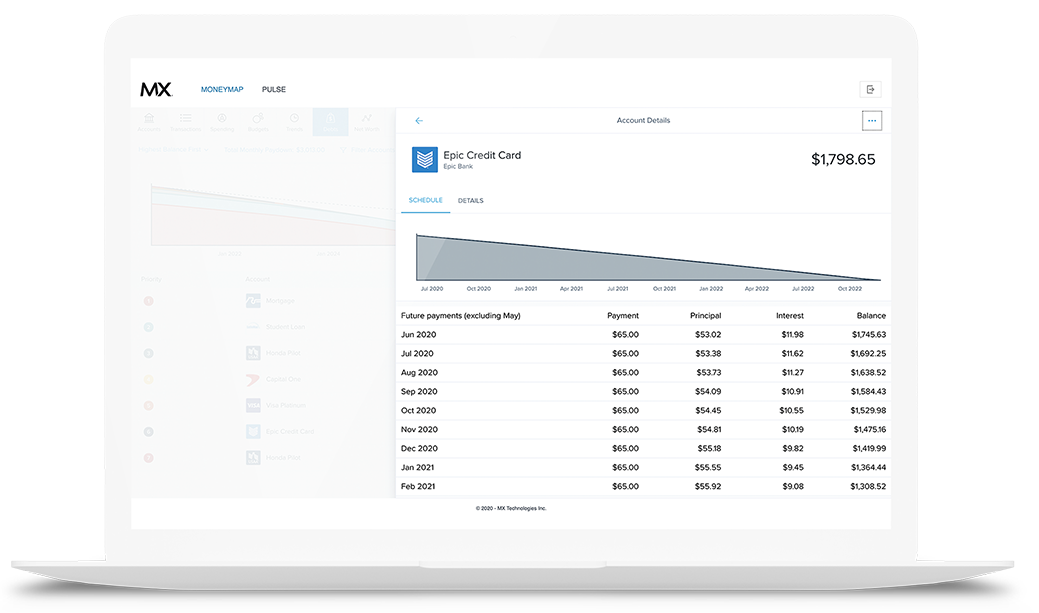

Perhaps more than anything, borrowing represents the clearest win-win opportunity for most customers and lenders —so long as customers maintain a healthy debt-to-income ratio. Because of this, it’s important for financial services companies to know what their customers’ total debt-to-income ratio is and dynamically visualize that data for their customers,nudging them bit by bit toward healthy levels. You can help customers consolidate their debt while working down their payments by showing them a personalized debt payment plan.

You can also offer guidance on maintaining a healthy credit score of at least 720 or more. By aggregating credit score information alongside automated guidance, you can offer personalized suggestions about how customers can improve their credit situation no matter where they are in the process.

5. Plan

Until recently, financial planning was something only the wealthiest could afford. But with the right digital tools at hand, it’s now possible for everyone to get affordable automated guidance. These tools enable you to make real-time recommendations to help customers plan for their future. And given that 64% of Americans have less than $10,000 saved for retirement, people desperately need help on this front.

In addition, you can help people plan for long-term financial obligations such as caring for a parent who doesn’t have enough in their retirement fund. A startup called Golden helps children of seniors manage their parent’s money in one place, get fraud alerts, and increase potential government benefits. Other financial management apps at financial institutions and fintech companies could integrate these features as well. It’s a matter of figuring out the range of needs for this demographic, from simple tasks such as helping parents pay their bills to incredibly complex tasks such as figuring out what outstanding loans they have, how to pay for senior housing, how to renovate the house to enable independent living, how to pay for paid caregivers, and so on.

Most of the time, these needs stem from a crisis point such as a parent falling and ending up in a hospital. If you provide customers with the right tools ahead of time, the crisis won’t be felt as acutely. As Unconventional Ventures Co-founder Theodora Lau says, “Just like putting a 529 in place for children for higher education, there is no reason why financial caregiving for parents can’t follow a similar route.” This task becomes even more urgent as Baby Boomers are set to retire en masse over the coming decade and their children become caregivers. Lau adds, “The technology is there for us to help these 40+ million family caregivers — if we are willing.”

So, are your customers prepared for their retirement or their parents’ retirement? Are they taking full advantage of their 401(k) match? Do they even know whether their company offers a match? Have you suggested that they create a will? Most importantly, do you offer data-driven products that automatically factor each customer’s long-term plans into account? These questions are all essential if you’re going to be a true financial advocate.

6. Protect

Everyone needs some form of protection against unwanted disasters —but not everyone knows the details of the protection they have and the protection they lack. By providing a checklist of what ideal protection looks like depending on life stage and financial situation, you can give your customers the peace of mind they need.

Protecting also entails helping customers get the right insurance for their primary assets, including homes, vehicles, and healthcare, all of which have enormous implications on budget and planning.

One overlooked area here has to do with connecting customers to the government benefits they can apply for. Mohamed Khalil, the General Manager of Digital Guidance at the Commonwealth Bank of Australia, has spearheaded a program to just this — a program that managed more than 400,000 interactions in the first year.

At first glance, financial services companies might think that helping customers apply for government benefits is way outside their scope of work. And yet Khalil’s program has resulted in $200m in additional funds at Commonwealth Bank. More money for customers means more deposits and loans for financial services companies.

So help your customers find the right insurance, file for unemployment, get the right tax refunds, and whatever else can best protect them financially.

7. Grow

Once all the basics are in order, it’s time for customers to grow their wealth. This includes investing in the stock market, owning property, and a range of other possibilities. Financial services companies can offer a premier concierge service to guide customers who reach this stage of financial strength, helping them to amass capital to put to use as they see fit.

At this point, you might even start thinking beyond customer lifetime value to consider intergenerational value. Given that those born into wealth are more likely to take risks, start a business, and bring in higher returns (4x larger, according to a report from the Federal Reserve), it’s worthwhile for the long-term viability of your company to help customers grow their wealth today.

From Stage to Stage: Financial Laddering

No matter where a customer is on their financial journey, the point is to guide them to the next step. If they’re living paycheck to paycheck, show them how to increase their income or save just a few dollars each month. If they’ve got a healthy amount of savings in the bank, show them how to start investing their money. People need help to get to the next stage, and you can be that help.

Case Study: LGFCU

To see how this process can work in practice, let’s look at an example from Local Government Federal Credit Union (LGFCU) in North Carolina.

LGFCU has a goal to help their members achieve financial strength. To do this they’ve implemented a range of products and services, including personal financial management from MX as well as an in-depth personal finance tab on their website that covers taxes, spending, debt management, estate planning, credit, insurance, and investing. Each section includes professional guidance as well as quizzes to help members understand their individual financial situation.

However, all of this wasn’t enough as far as LGFCU was concerned. They wanted to get a clear sense of what their members actually needed across the board. To this end, they gathered nearly 4,000 responses from a member survey as well as analytics from the MX platform from more than 5,000 members. LGFCU then aggregated all this data and placed their members into three categories based on spending, saving, borrowing, and planning:

1. Vulnerable: Members who are struggling with all or nearly all aspects of their financial lives.

2. Coping: Members who are struggling with some but not necessarily all aspects of their financial lives.

3. Healthy: Members who are spending, saving, borrowing, and planning in a way that will allow them to be resilient and pursue big opportunities over time.

Once they learned the distribution of their members' health scores, they analyzed what qualities led someone to be financially strong. They found that a consistent pattern of behaviors leads to financial health: having an emergency fund and adequate insurance, spending less than earnings, taking on a manageable level of debt, and practicing proactive planning. In addition, they found that an increase in income correlated with (but wasn’t always a guarantee of) having financial strength.

LGFCU is now using this data to implement strategies to help their members make smarter decisions and increase their financial strength every step of the way. They’re set to become a true financial advocate.

Conclusion: Now What?

In the end, financial advocacy is about win-win outcomes. As you transition from short-term, quarterly thinking to doing what’s right for your customers at every stage of their financial journey, you set yourself up for success over the decades to come. Your brand will shine as a trusted source in the industry, and over time you will win loyalty and market share.

Start by making a commitment to transition from being a financial intermediary to being a financial advocate. Make sure everyone at your institution knows the difference and why the difference matters, including how advocacy ties in with customer expectations around financial habits. At that point, you can roll out an advocacy plan that encourages customers to follow the seven steps to true financial strength: earn, spend, save, borrow, plan, protect, and grow. As your employees and customers follow these steps, you’ll become a true advocate alongside the best of the industry.

Want to see how you can provide automated financial guidance and become a true financial advocate?

The Ultimate Guide to Financial Advocacy

The Ultimate Guide to Financial Advocacy