Ready to Get Started?

Learn more about how MX can improve your customer’s journey, uncover growth opportunities, and help you innovate faster.

MX helps bolster fraud prevention and mitigate risk for financial institutions and fintechs. Build trust and help protect consumers with tokenized connections that eliminate credential sharing, real-time verifications and balance checks, and cleansed and enhanced transaction data that can help you spot anomalies faster.

Validate bank accounts and other financial accounts in less than 5 seconds with the latest security standards through direct OAuth connections, eliminating reliance on microdeposits

Leverage token-based APIs between MX and payment processors for more flexible and secure data sharing to fuel money movement and more

Protect credentials from leaving your organization by leveraging tokenized direct API and OAuth connections

Make it easy for consumers to connect external accounts in a few simple steps and gain a more complete picture of their finances

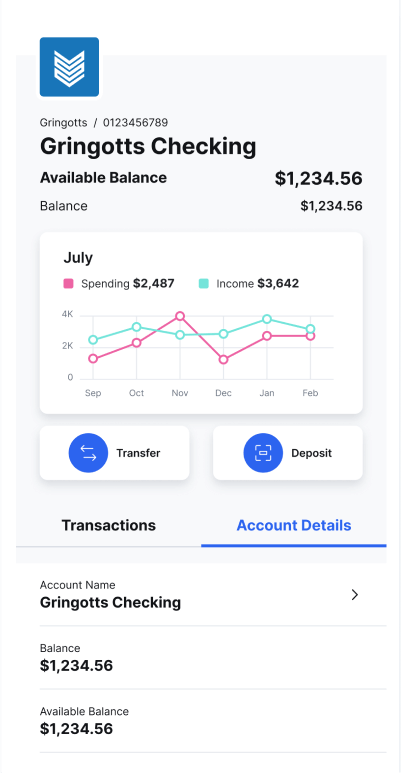

Enhance transaction data with context, cleansing, and categorization to help you more quickly and easily identify abnormalities in transaction history and location data

Ready to Get Started?

MX offers a secure, open finance Data Access API platform built on FDX standards that ensures consumers are in control of their financial data and businesses have greater visibility into what data is shared.

MX offers a comprehensive suite of data enhancement services to deliver enhanced, verified financial data to improve money experiences, drive new growth opportunities, enhance decision making, and make better use of time and resources.

MX delivers fast, reliable verification technologies to help organizations better manage risk, protect against cyberattacks, and maintain compliance. MX reduces reliance on manual verification processes with instant account verifications (IAV) and account owner identification.

MX helps financial institutions and fintechs verify account balances quickly to streamline processes, reduce risk, and deliver a better customer experience.

Learn more about how MX can improve your customer’s journey, uncover growth opportunities, and help you innovate faster.