Are You Evolving with Generations of Consumers?

April 25, 2025 | 3 min read

Blog

Blog

April 22, 2016|0 min read

Copied

You might say that Millennials hate Wall Street.

After all, Millennials made up more than 60 percent of the Occupy Wall Street protesters in 2011, and they listed all four of the biggest US banks among their top 10 least loved brands.

And yet when it comes to where Millennials actually put their money, big banks dominate.

It turns out that Millennials are actually the most likely demographic to choose a big bank for financial services — more likely than Gen X or Boomers. In addition, millennials are the group least likely to join a credit union.

Those statistics, which come from two separate studies (one at Digital Fieldwork and one from Ron Shevlin at Aite Group), might initially seem perplexing. How could Millennials list the four biggest banks among their most-hated brands and still be most likely to choose those banks for their financial needs?

At first glance it might seem like all Millennials are hypocrites. It might seem like that’s all there is to it. Cased closed. But there’s something much bigger at play here. Millennials might legitimately dislike the practices of the big banks and simultaneously like the convenience big banks offer. The thing is, their draw toward convenience might simply trump their disdain for the big banks.

We see evidence for this over and over.

Take Bank of America, for instance. In 2011, Bank of America focused primarily on providing convenience and was the first financial institution to launch mobile banking on the iPhone. The results were impressive. More than six million people downloaded the app, and a quarter of a million joined Bank of America specifically to use mobile banking.

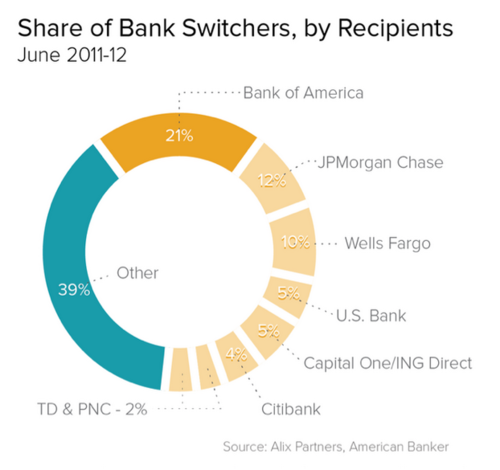

The app generated an enormous return on investment for Bank of America. To illustrate, from June 2011 to June 2012 more people switched to Bank of America than any other financial institution in the United States.

All this growth came despite the fact that Bank of America was deemed as the main villain during Bank Transfer Day in November 2011 (a grassroots movement to switch from big banks to credit unions). What’s more, in 2011 it scored the lowest of any financial institution on a customer satisfaction survey — 11 percentage points below the industry average.

In retrospect, Bank of America’s gains might not be surprising. After all, Bank of America simply gave users what they wanted: convenience.

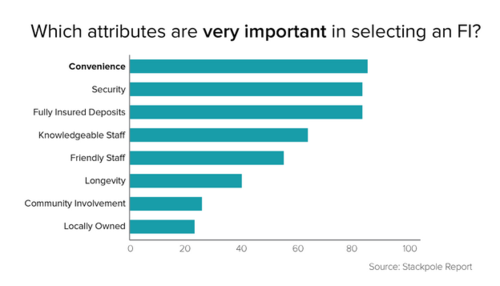

And, to put it bluntly, convenience is king. Just look at these results from Stackpole Report:

It turns out that Millennials generally want to support locally owned businesses, but they want convenience more. It follows, then, that Millennials would understandably be more likely to choose big banks because the big banks invest more heavily in the financial technologies that make banking more convenient.

'Millennials are very pragmatic and have high expectations around technology. If convenience and functionality aren’t there [at credit unions], they’ll do business with banks even if they do not always respect their values. — Laurie Paleczny, co-founder of Digital Fieldwork

What does this mean for smaller players in the financial industry? It means that it’s more important than ever to figure out ways to compete in the world of fintech. Smaller players likely don’t have the same resources to develop financial technology in-house, but they can find inexpensive partnerships that can give them an edge on the big banks.

If community banks and credit unions don’t move quickly to answer the needs of Millennials, then new financial players —like Moven, Walmart, or Google — are set to do so. Not only are these new competitors free of the damaged branding that big banks have, but they're becoming just as convenient as traditional financial institutions. After all, nothing is more convenient than having a full banking experience available on your phone at all times. And that’s what these new players aim to provide.

Some bankers and analysts think that Google, Facebook, Amazon or the like will not fully enter a highly regulated, low-margin business such as banking. I disagree. What is more, I think banks that are not prepared for such new competitors face certain death. — Francisco Gonzalez, BBVA's chairman and CEO

In sum, the shift in the financial industry cannot be understated. To illustrate, Accenture recently published a number of key statistics:

If smaller players in the financial industry are not fully prepared for the demands for convenience, including the demand for better budgeting software, they should be worried about what the next 10 years will bring — especially since by 2025, Millennials will represent as much as 75 percent of the workforce. On the other hand, if you’re making legitimate efforts to make banking more convenient, you have every reason in the world to be excited about the future. Because convenience is king.

April 25, 2025 | 3 min read

April 23, 2025 | 6 min read

March 25, 2025 | 3 min read